Synthetic Indices Deriv guide for smart trading

.webp)

Volatility lies at the heart of every trading decision — it defines how markets move and how traders manage risk and opportunity. On Deriv, volatility is represented through synthetic indices: mathematically generated markets designed to mirror real-world price behaviour without being influenced by economic data, news, or liquidity changes.

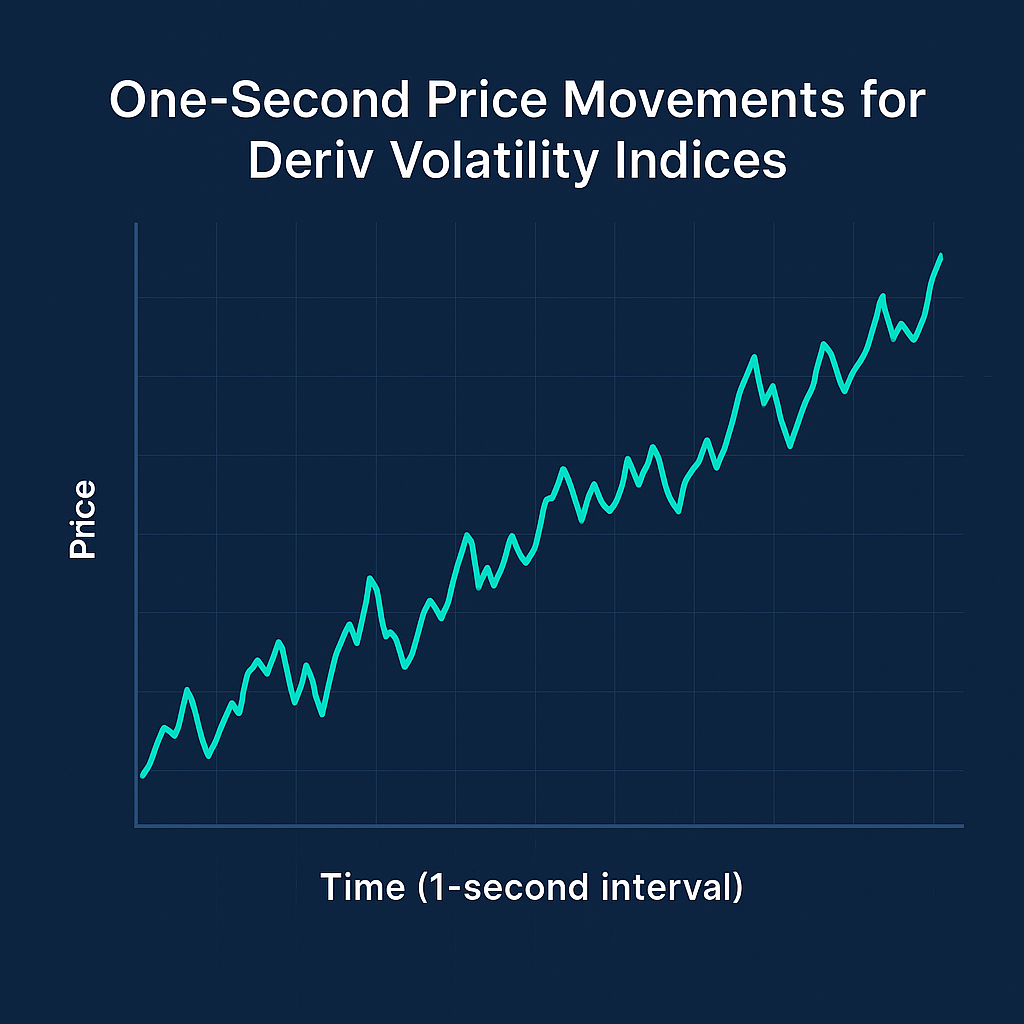

In 2025, Deriv strengthened its synthetic ecosystem by introducing fifteen indices available on both Deriv MT5 and Deriv cTrader. These one-second tick instruments deliver faster execution, more refined volatility control, and seamless automation via cBots and Expert Advisors (EAs). Together, they reinforce Deriv’s position as a leader in transparent, data-driven synthetic markets, built for traders who value precision and stability.

These indices promote consistency and flexibility. They allow traders to test, refine, and automate strategies in an always-on environment, ideal for algorithmic development, educational use, and strategy optimisation.

Quick summary

- Synthetic indices replicate market behaviour with fixed volatility levels (10%, 15%, 30%, 90%, 100%, 150%, and 250%).

- Crash/Boom indices represent event-based markets with probabilistic price spikes or drops.

- The new one-second series includes Volatility 15, 30, and 90 (1s), plus Boom 600, Crash 600, Boom 900, and Crash 900 — all available on Deriv MT5 and Deriv cTrader.

- The one-second series bridges traditional volatility concepts like the VIX with synthetic consistency, enabling traders to plan around predictable volatility regimes.

What are synthetic indices on Deriv and why do they matter?

Deriv’s synthetic indices are algorithm-based instruments that maintain statistically consistent volatility conditions, simulating real market dynamics in a controlled environment. These include Volatility, Range Break, Drift Switch, Step, and Crash/Boom indices.

Volatility indices represent constant volatility levels, while Crash/Boom indices introduce stochastic elements, generating price spikes or drops based on event probabilities. This structure enables traders to experience realistic market behaviour without external disruptions, perfect for strategy testing and automation.

They offer continuous data streams for studying market reactions, backtesting automated systems, and teaching volatility management in isolation from global events.

How do Deriv MT5 and Deriv cTrader support one-second volatility indices trading?

The 2025 expansion marks a major step in Deriv’s synthetic-trading evolution. According to Prakash Bhudia, Deriv’s Head of Product & Growth:

“The new indices “amplify opportunities by giving traders faster, cleaner access to volatility patterns without needing complex technical setups.”

These developments make synthetic markets more practical for quantitative analysts, educators, and active traders exploring volatility systematically.

How do Crash Boom indices, Range Break, and Drift Switch differ?

The table below outlines each index family and its trading applications.

Notes: “σ” denotes volatility; event frequency = long-term average, not fixed timing.

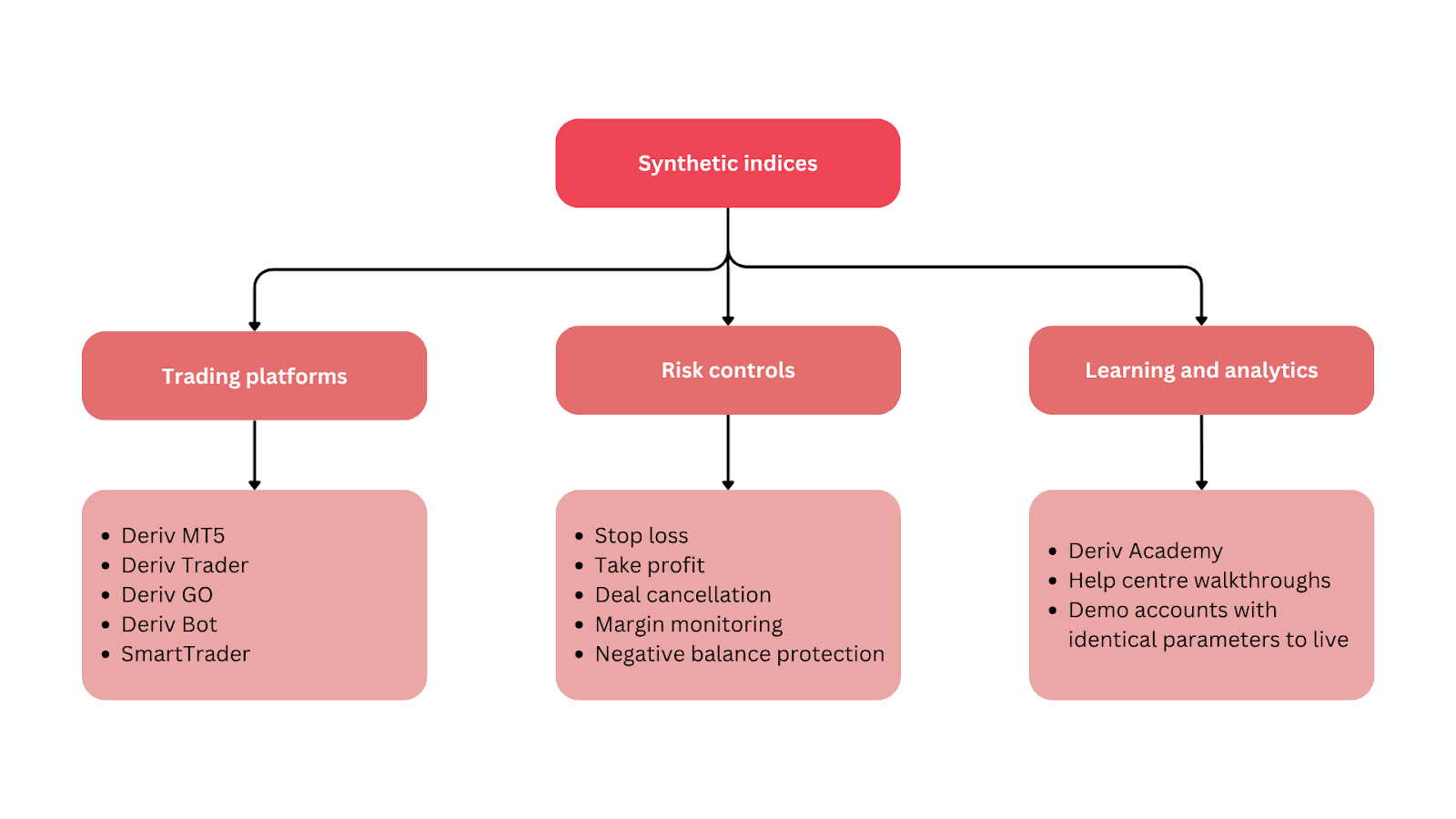

Where to trade and what each platform offers

- Deriv cTrader — Advanced order types, Depth of Market, and cBots automation. Best for 1-second indices and Crash/Boom 600–900 series.

- Deriv MT5 — Multi-asset platform supporting EAs and hedging. Ideal for combining synthetic indices with forex, cryptocyrrencies, and derived assets in one account.

- Deriv Trader — Simplified interface for multipliers and options; offers fixed-risk control.

- Deriv GO — Mobile app for tracking trades and exposure.

- Deriv Bot — No-code automation builder for basic strategies.

Each platform integrates within Deriv’s ecosystem, enabling traders to develop and move strategies from demo to live seamlessly.

Which synthetic trading strategies suit each volatility environment?

Crash and Boom indices model sudden price moves — upward booms or downward crashes. Each tick carries a small chance of a major move:

- Crash 600 ≈ one large drop every 600 ticks on average.

- Boom 900 ≈ one major spike every 900 ticks on average.

This stochastic structure supports two main tactics:

- Breakout strategies — enter as the spike begins and trail the move.

- Fade strategies — trade in the opposite direction once volatility settles.

By studying spike frequency and size, traders can design realistic stops and manage drawdowns effectively.

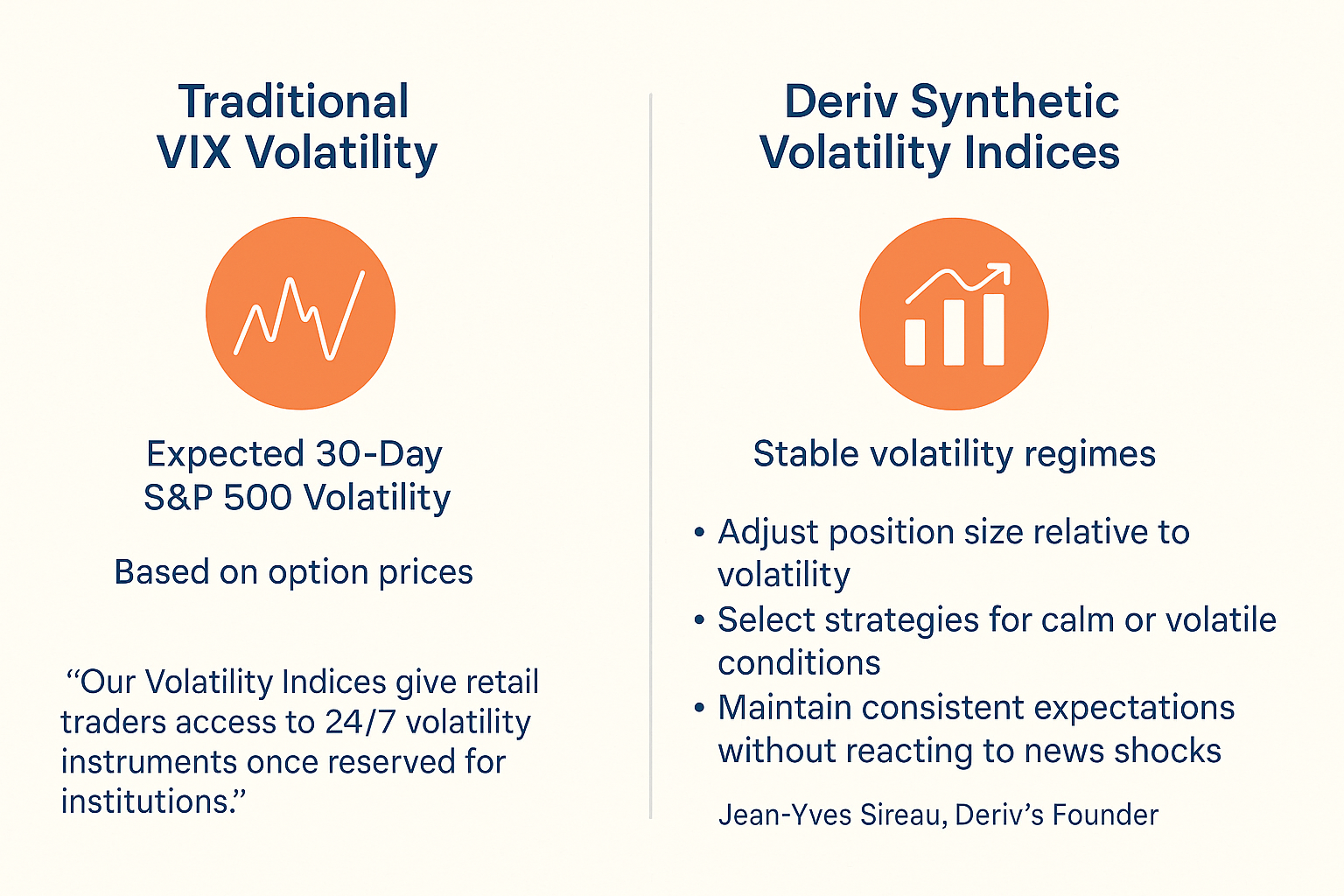

Synthetic volatility and the VIX analogy

In traditional markets, the VIX measures expected 30-day S&P 500 volatility. Deriv’s synthetic indices play a similar analytical role — representing stable volatility regimes for planning and comparison. Unlike the VIX, Deriv’s indices are derived from cryptographically-secure algorithms rather than option prices.

This analogy helps traders:

- Adjust position size relative to volatility.

- Select strategies for calm or volatile conditions.

- Maintain consistent expectations without reacting to news shocks.

As Jean-Yves Sireau, Deriv’s Founder, notes:

“Our Volatility Indices give retail traders access to 24/7 volatility instruments once reserved for institutions.”

What are the best algorithmic trading tools for Deriv’s synthetic markets?

- Volatility 15 (1s) – Micro-scalping and mean reversion using MA, RSI, and Bollinger Bands with tight stops.

- Volatility 30 (1s) – Balanced setup for short-term momentum; combine MA crossovers with ATR-based stops.

- Volatility 90 (1s) – For breakout systems with wider stops; use time-based exits to reduce churn.

- Crash/Boom 600–900 – Event-driven tactics; trade breakouts or reversals with ATR trails and structured risk limits.

Rakshit Choudhary, Deriv’s CEO, elaborates:

“The company’s goal is to advance AI-first trading technology and empower traders with precision tools for the next decade.”

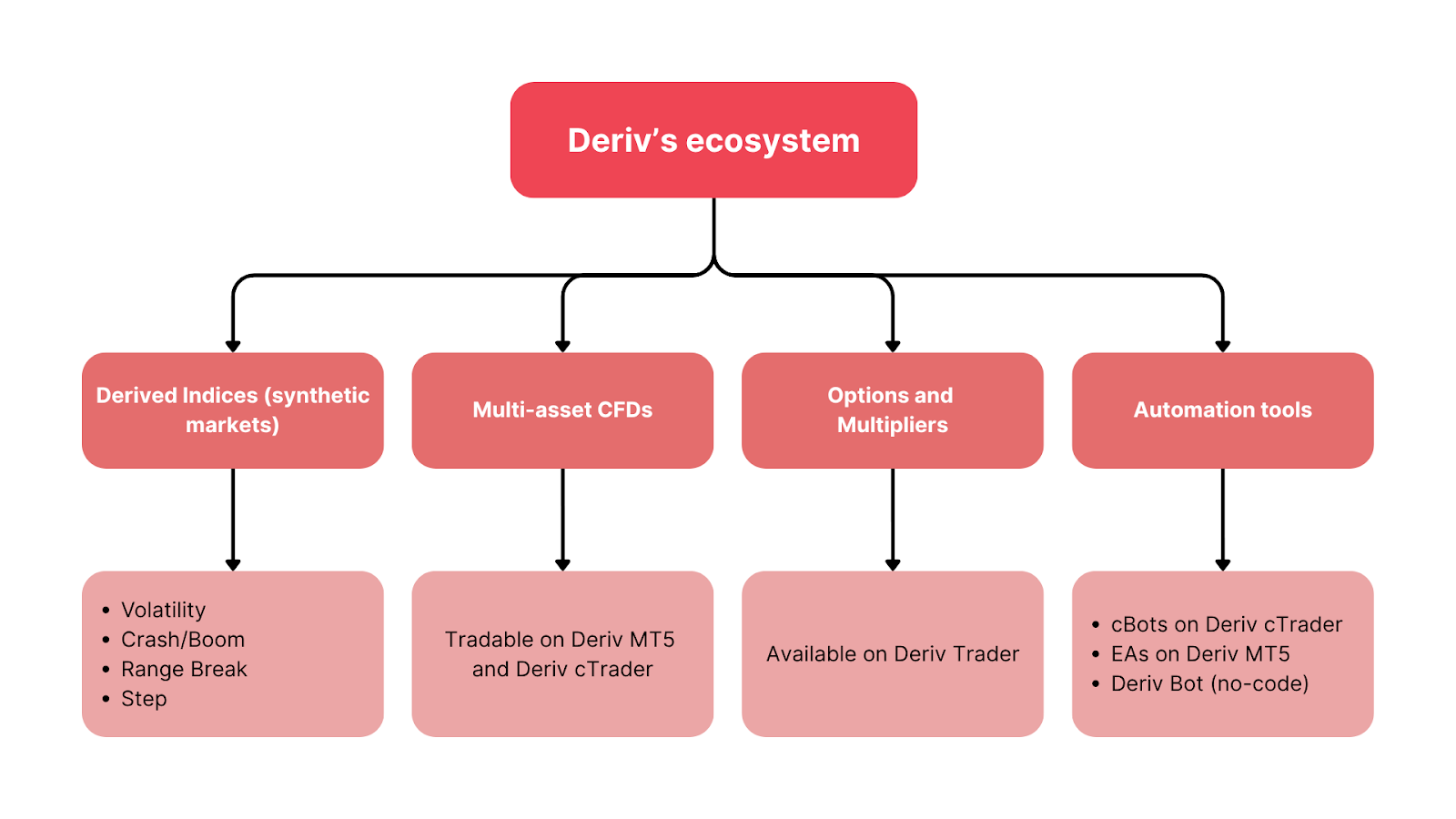

How Deriv’s ecosystem links its markets

Deriv’s infrastructure connects all its markets and platforms, creating a unified environment for education, testing, and live execution. Deriv operates with cryptographically-secure random-number generation (RNG) and transparency standards to ensure fair synthetic market behavior.

Ecosystem overview:

- Derived indices – Volatility, Crash/Boom, Range Break, Step.

- Multi-asset CFDs – Tradable on Deriv MT5 and Deriv cTrader.

- Options & multipliers – Available on Deriv Trader.

- Automation tools – cBots, EAs, and Deriv Bot (no-code).

This network lets traders build, test, and scale strategies fluidly. Lessons from synthetics — on leverage, stop placement, and drawdown control — translate directly into other asset classes.

Disclaimer:

Some trading conditions, indices, and platforms are unavailable for clients in the EU.