O trilema de 2024: Inflação, estagflação ou aterragem suave

Esqueça as bolas de cristal; o sucesso em 2024 depende da capacidade de navegar num panorama em mudança moldado pelo aperto das políticas monetárias e pela alteração das dinâmicas de poder em 2023.

Embora um cenário de base desenhe um quadro de crescimento gradual, correntes ocultas de risco e oportunidade giram logo abaixo da superfície. Esta perspetiva para 2024 analisa as principais tendências e desafios que os investidores de mercado podem enfrentar para desbloquear o potencial sucesso no ano que se avizinha.

EUA: Aterragem suave, mas atenção aos ventos inflacionários

As poupanças excedentárias dos consumidores estão a diminuir, e as taxas de juro mais elevadas estão a afetar a procura de bens, serviços e habitação. Embora se espere um enfraquecimento temporário do crescimento trimestral do Produto Interno Bruto (PIB) dos EUA no início de 2024, um conjunto mais alargado de analistas económicos não prevê uma recessão total.

É importante considerar as condições de mercado e as análises fundamentais ao fazer investimentos.

A Reserva Federal prevê uma moderação contínua da inflação geral e um crescimento económico mais lento em 2024 antes de atingir o seu objetivo de 2% no Índice de Preços ao Consumidor (IPC) até ao quarto trimestre de 2026.

A Reserva Federal, num delicado ato de equilíbrio, observa tanto o crescimento lento como a inflação persistente. A sua recente pausa nos aumentos das taxas sugere um reconhecimento da lentidão, alinhando-se com as leituras essenciais das Despesas de Consumo Pessoal (PCE) que potencialmente poderão descer abaixo das projeções.

No entanto, as memórias da inflação transitória permanecem frescas, e as preocupações sobre o ressurgimento das pressões sobre os preços devido ao crescimento excecional ou a potenciais choques petrolíferos persistem. Como o próprio Jerome Powell adverte, não foram descartados novos aumentos das taxas. Três cortes de taxa de um quarto de ponto estão em cima da mesa para 2024, de acordo com as atas de dezembro do Comité Federal de Mercado Aberto (FOMC), mas é incerto quando serão implementados.

Acrescentando à complexidade está o panorama em mudança dos rendimentos do Tesouro. O poder de compra reduzido da Fed e o défice orçamental dos EUA em rápido crescimento criam uma tempestade perfeita para o aumento das taxas de juro a longo prazo. A diminuição da procura estrangeira por títulos do Tesouro e o relaxamento do controlo da curva de rendimentos por parte do Japão alimentam ainda mais a trajetória ascendente. Não obstante, é crucial lembrar que estes rendimentos estão meramente a corrigir-se a partir de níveis historicamente baixos e de uma inversão prolongada. Os mercados de ações dos EUA estão prontos para navegar na primeira metade do ano, orientando-se pelos fundamentos subjacentes e pelas divulgações de dados económicos, com potenciais mudanças ou incertezas geopolíticas a surgirem posteriormente.

China: Abrandamento do crescimento vai ao encontro dos objetivos a longo prazo

O otimismo inicial de 2024 para uma China pós-pandemia desvaneceu-se à medida que uma prolongada queda no setor imobiliário, o aumento do desemprego jovem e as incertezas regulatórias travaram o mercado. Com a construção e o setor imobiliário há muito a alimentar o motor da economia, a crise imobiliária tem repercussões profundas, desencadeando vendas significativas de acções.

Um vislumbre de esperança brilha de um potencial aumento do yuan em 2024, o primeiro em três anos. Uma redução na diferença das taxas de juro poderá estancar a saída de capital, conforme previsto por um inquérito da Bloomberg. No entanto, os cortes limitados nas taxas e um resgate pouco claro para o setor imobiliário lançam sombras sobre a recuperação. Os investidores estrangeiros permanecem à margem, aguardando uma ação governamental decisiva antes de voltarem a investir. Apesar dos desafios, os líderes chineses expressam uma confiança inabalável na sua visão a longo prazo para a transformação económica do país. As reformas estruturais visam a prosperidade comum e o crescimento sustentável, exemplificados pelo compromisso da China de atingir o pico das emissões de carbono em 2030 e alcançar a neutralidade carbónica até 2060.

O Japão vai finalmente terminar com as taxas de juro

O iene enfrenta uma pressão renovada na sequência de um significativo sismo do Dia de Ano Novo no Japão, complicando os esforços do Banco do Japão para eliminar as taxas de juro negativas este mês. Embora não seja provável que haja alterações em janeiro, a maioria das pessoas espera que as taxas de juro negativas terminem em abril ou mais tarde em 2024. Isto sugere que poderá haver uma maior volatilidade no valor do iene japonês.

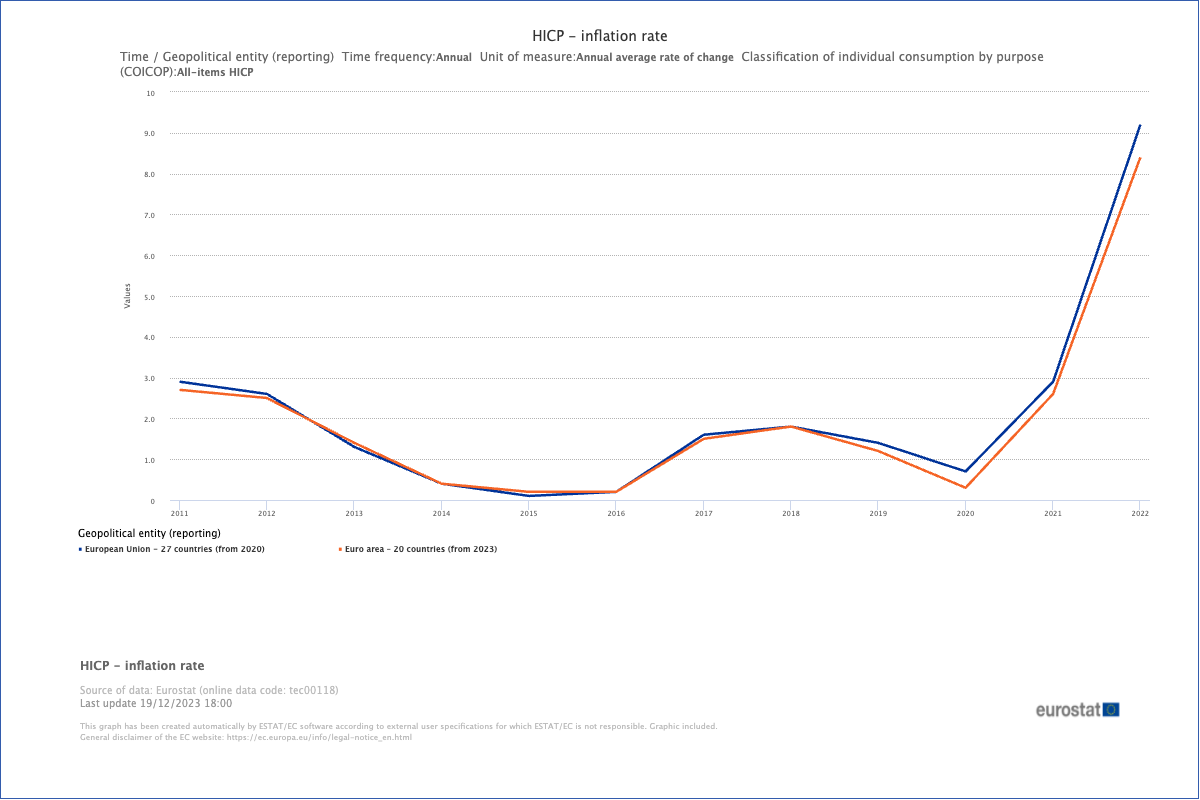

Zona Euro, Reino Unido: Combate às pressões inflacionárias

O Reino Unido e a Europa devem experienciar uma leve recessão e um crescimento mínimo em 2024, caracterizados por um crescimento mais lento e uma inflação persistente.

A inflação tem sido mais persistente nestas regiões devido à sua maior dependência de importações de matérias-primas e energia. Prevê-se que os preços da energia e das matérias-primas se mantenham acima dos níveis anteriores à crise, influenciados pelas incertezas geopolíticas e pelos cortes previstos nas taxas de juro dos EUA. Consequentemente, prevê-se que as taxas de juro de referência na UE e no Reino Unido se mantenham mais elevadas durante mais tempo para controlar a inflação.

As taxas de juro mais elevadas tendem a ter efeitos visíveis na dívida pública, levando a um aumento contínuo da dívida nacional. Com uma dívida substancial resultante da pandemia e do conflito na Ucrânia, a capacidade dos governos da UE e do Reino Unido para estabilizarem as suas economias está a diminuir. As opções limitadas para estímulos fiscais adicionais resultam num cenário de estagflação, ao contrário dos EUA, onde o crescimento se mantém resiliente e a inflação está sob controlo.

Mercados emergentes: Afirmando-se por si próprios

À medida que as taxas de juro nos EUA arrefecem e o dólar abranda a sua pressão, JP Morgan prevê um ressurgimento nos mercados emergentes durante a segunda metade de 2024. Este ímpeto é alimentado por uma mudança global nas cadeias de abastecimento, escapando à longa sombra da dominância da China.

Os beneficiários deste realinhamento incluem regiões como a América Latina, a Europa, o Médio Oriente e África (EMEA), a Associação das Nações do Sudeste Asiático (ASEAN) e a Índia. Estas estrelas em ascensão oferecem uma potente combinação de mão de obra económica, uma produção robusta e um tesouro de produtos essenciais. Com um cenário industrial agitado, uma vasta força de trabalho e recursos naturais como energia, cobre e lítio (o elemento vital dos veículos elétricos (VE) e das energias renováveis), a América Latina destaca-se como uma forte concorrente.

O aumento do investimento direto estrangeiro (IDE) desenha um quadro vibrante para a ASEAN, com o Vietname a liderar este movimento. As principais empresas que procuram diversificação estão a estabelecer-se, sendo o crescimento estelar do Vietname um caso exemplar. Na área tecnológica, a Malásia surge como campeã do empacotamento e teste avançados de semicondutores, enquanto Singapura reina suprema como um centro de fabricação de wafers. A riqueza de níquel da Indonésia e a cadeia de fornecimento automóvel estabelecida da Tailândia tornam-nos intervenientes vitais no jogo dos veículos elétricos.

Os recentes triunfos eleitorais de Narendra Modi reforçaram o já impressionante crescimento da Índia, impulsionado por mudanças no fornecimento global e custos de mão de obra competitivos. Isto traduz-se em máximos históricos para as ações indianas em 2024, com o Sensex e o Nifty a atingirem novos picos vertiginosos.

Embora a incerteza possa persistir, o potencial para uma recuperação robusta nos mercados emergentes durante a segunda metade de 2024 parece tentador. Com taxas mais baixas, um dólar mais fraco e cadeias de abastecimento em mudança, estas estrelas em ascensão estão prontas para captar as atenções e redefinir o panorama económico global.

Inteligência artificial: Foco nos semicondutores

O recente avanço na IA é um ponto de viragem para a globalização. Destaca-se como um aspeto fundamental para 2024 com profundas implicações para o trading e os investimentos.

A IA generativa é um tipo de algoritmo de IA que cria conteúdo com base em dados existentes. Impulsiona a inovação em várias indústrias para além da tecnologia — desde os transportes e cuidados de saúde até à educação e ao retalho. Os beneficiários notáveis incluem empresas de jogos, fabricantes de veículos elétricos, intervenientes no comércio eletrónico e prestador de serviços na nuvem.

Os analistas preveem uma perspetiva positiva para o setor dos semicondutores em 2024. Prevê-se que a indústria mantenha a sua recuperação da queda de 2022 e apresente crescimento em todos os segmentos. Os avanços na IA dependem fortemente de chips semicondutores de alta qualidade para o processamento e análise de dados. As tensões comerciais em curso entre os Estados Unidos e a China no setor dos semicondutores criaram um desequilíbrio entre a oferta e a procura. Isto resultou num aumento dos preços e das margens para os semicondutores, afetando as avaliações das empresas de semicondutores.

Em 2023, a indústria dos semicondutores recuperou, e um fator significativo por detrás deste ressurgimento é a NVIDIA Corp. (NVDA), uma líder no mercado em expansão de Unidades de Processamento Gráfico (GPU) para aplicações de IA. As ações da Nvidia tiveram um aumento superior ao triplo, tornando-a o primeiro fabricante de chips a alcançar uma capitalização de mercado superior a 1 bilião de USD. Outro jogador notável no setor de IA, a Advanced Micro Devices Inc. (AMD), reivindicou o segundo lugar entre os componentes do índice, experimentando um notável aumento das ações de quase 130% este ano.

Para além dos fabricantes de chips nos EUA, Singapura e Malásia, como mencionado anteriormente, outros beneficiários claros incluem a Coreia e Taiwan. As fábricas coreanas estão a desenvolver a próxima geração de chips de memória de alta largura de banda que beneficiarão da adoção generalizada da IA. Taiwan orgulha-se de uma cadeia de abastecimento industrial completa que suporta as tendências atuais e futuras da indústria de IA.

Riscos a monitorizar: Instabilidade geopolítica e financeira

Em 2024, durante um ano eleitoral crucial, as tensões e os riscos geopolíticos globais estão a aumentar. Dois conflitos importantes e eleições em 40 países, incluindo grandes potências como os EUA, o Reino Unido e a UE, contribuem para a incerteza. A Morgan Stanley prevê uma maior volatilidade nos ativos de maior risco em comparação com o ano anterior.

Os canais de investimento e as cadeias de abastecimento estão intrinsecamente ligados à liderança de cada país. As tensões contínuas entre os EUA e a China, o conflito Rússia-Ucrânia e o persistente conflito Israel/Hamas são fatores de risco substanciais.

Adicionalmente, as preocupações sobre o abrandamento do crescimento económico levantam questões sobre a sustentabilidade fiscal dos governos e a dívida das empresas. A Eastspring Investments, sediada em Singapura, adota uma postura defensiva no espaço de crédito dos EUA, preferindo obrigações de grau de investimento dos EUA em vez de obrigações empresariais de alto rendimento. A sua investigação indica uma potencial subvalorização dos riscos de refinanciamento empresarial à medida que a barreira de maturidade se expande nos próximos anos.

Tanto a UE como os EUA estão a lidar com uma ameaça crescente de incumprimentos em empréstimos imobiliários comerciais, representando riscos para as instituições financeiras. Os custos de financiamento mais elevados, as potenciais fragilidades do capital regulatório e os riscos crescentes associados aos empréstimos imobiliários comerciais, juntamente com a diminuição da procura por espaços de escritórios, levam a uma análise dos bancos. O Moody's Investors Service baixou a classificação de crédito de 10 bancos norte-americanos de menor dimensão e poderá estender esta medida a grandes credores como o US Bancorp, o Bank of New York Mellon, o State Street e o Truist Financial, destacando as crescentes pressões sobre o setor.

Apesar de um aumento nas rendibilidades das obrigações, os spreads de crédito surpreendentemente não se alargaram de forma significativa. Este fenómeno desempenhou um papel na minimização de falências e perdas de emprego. Os analistas de vários dos principais bancos de Wall Street preveem uma ligeira deterioração das condições de crédito em 2024, proporcionando uma proteção para as empresas, os empregos e o crescimento económico global contra um declínio mais grave.

Conclusão

Navegar pelo panorama de investimento em mudança em 2024 requer uma compreensão clara dos fatores macroeconómicos, das estratégias de alocação de ativos e do papel da inteligência artificial nas empresas e nos ativos privados.

Na primeira metade de 2024, a trajetória dos mercados está prestes a ser fortemente influenciada pelos fundamentos económicos em curso, uma vez que as ramificações das eleições e os potenciais riscos de crédito ainda não foram totalmente avaliados.

Embora os investidores possam normalmente antecipar e preparar-se para vários riscos, a ameaça mais significativa surge frequentemente de uma "bola curva" inesperada — um evento que apanha todos de surpresa. Como estes eventos não são considerados nos preços de mercado, podem causar grandes perturbações quando ocorrem. Exemplos recentes incluem a pandemia de COVID-19 imprevista e a guerra na Ucrânia, ambos eventos que poucos investidores esperavam. Reconhecendo a natureza imprevisível do panorama financeiro, é sensato ter em conta potenciais desafios imprevistos também em 2024.

Isenção de responsabilidade:

A informação presente neste blog destina-se exclusivamente a fins educativos e não deve ser interpretada como aconselhamento financeiro ou de investimento. É considerado preciso à data de publicação pelas fontes. Alterações nas circunstâncias após a data de publicação podem influenciar a precisão das informações.

Negociar envolve riscos. O desempenho passado não é indicativo de resultados futuros. É aconselhável fazer a sua própria investigação antes de tomar qualquer decisão de negociação.

A lira turca é uma moeda importante que permite aos investidores negociar pares de divisas.