Kwa nini dhahabu na fedha zinavunja rekodi mwaka 2025

Dhahabu na fedha zinavunja rekodi mwaka 2025 kwa sababu mahitaji ya kimuundo, mabadiliko ya sera, na uhaba halisi vimetokea kwa wakati mmoja, na kusukuma metali zote mbili kufikia viwango vya juu vya wakati wote. Dhahabu imepanda karibu 60% mwaka huu na kufanya biashara karibu $4,200 kwa aunsi, baada ya kushuka chini ya $4,000 mwishoni mwa Oktoba/mapema Novemba. 4000 imekuwa sakafu ya bei kisaikolojia katikati ya Novemba. Wakati wa kuandika, dhahabu inafanya biashara katika kiwango cha 4200. Wakati fedha imeongezeka karibu mara mbili katika miezi 11, ikipanda hadi viwango vipya karibu $56. Hatua hizi sio milipuko ya kubahatisha - zinaonyesha nguvu kubwa zinazopishana zinazounda upya masoko ya kimataifa.

Hatua ya mabadiliko kwa metali za thamani

Utendaji huu wa hali ya juu umekuwa lengo kuu katika masoko ya fedha mwaka 2025, hasa kwa tofauti kubwa na utendaji wa kihistoria. Benki kuu zinaongeza kasi ya ubadilishaji wa akiba, wakati watengenezaji wanaotumia fedha kama malighafi wanashindania usambazaji mdogo wa kifizikia. Wawekezaji wanajiweka sawa kwa ulimwengu ambapo kupunguzwa kwa viwango vya riba kunarudi na mshtuko wa kijiografia na kisiasa unaendelea. Kuelewa mabadiliko haya ni muhimu kuona wapi dhahabu na fedha zinaweza kuelekea baadaye - na nini kupanda kwao kunaashiria kuhusu hali ya uchumi wa dunia.

Nini kinachochochea kupanda kwa dhahabu na fedha

Kupanda kwa dhahabu mwaka 2025 kunategemea misingi iliyojengwa kwa miaka kadhaa. Ununuzi wa benki kuu umekuwa kichocheo kikubwa cha mahitaji katika miezi ya hivi karibuni. Katika miezi 11 iliyopita, dhahabu imerekodi mapato chanya katika miezi 10, ikisaidia bei za papo hapo kupanda zaidi ya 60% na kuweka metali hiyo kwenye njia ya utendaji wake bora wa kila mwaka katika karibu nusu karne. Hii sio povu la kubahatisha bali ni bima ya muda mrefu ya kwingineko dhidi ya kuyumba kwa sarafu, hatari ya vikwazo na kuongezeka kwa matatizo ya kifedha.

Maendeleo katika mapato ya Treasury pia yamekuwa kichocheo kikuu. Matarajio ya kupunguzwa zaidi kwa viwango vya riba kutoka Federal Reserve ya Marekani na benki nyingine kuu yamesukuma mapato halisi chini, kudhoofisha dola na kufanya mali zisizo na mapato, kama vile dhahabu, kuvutia zaidi.

Wawekezaji wanaotafuta kujikinga dhidi ya mfumuko wa bei sugu, kuongezeka kwa nakisi na soko la hisa lililojikita kupita kiasi wanapata nanga chache za kuaminika. Dhahabu, ambayo inabaki juu ya alama muhimu kisaikolojia ya $4,000, inajithibitisha tena kama kinga rahisi zaidi dhidi ya picha ngumu ya kiuchumi.

Mkutano wa fedha unaochochewa na uhaba

Hadithi ya fedha, ingawa imeunganishwa na mkutano wa metali ya thamani ya dhahabu, ina hadithi tofauti. Katika miezi 11 tu, metali hiyo imepata takriban 94%, huku bei zikifikia rekodi za juu za karibu $56.60 kwa aunsi.

Kupanda kwa fedha kumeunganishwa na mahitaji ya kiviwanda ambayo yamekua kwa kasi kuliko usambazaji kwa miaka kadhaa. Orodha ya hifadhi za London imepungua kutoka takriban tani 31,000 katikati ya 2022 hadi karibu tani 22,000 mapema 2025. Mnamo Oktoba, viwango vya kukodisha vya usiku kucha vilipanda hadi sawa na 200% kwa mwaka wakati wafanyabiashara walipohangaika kupata metali - ishara tosha ya msongo wa soko. Hali ya London inafanana na ya China, kwani nchi hiyo pia iliona umiliki wake ukipungua, huku mauzo ya nje yakifikia rekodi ya juu ya tani 660.

Wakati huo huo, kuongezeka kwa ununuzi wa msimu nchini India na nguvu inayoendelea katika utengenezaji wa nishati ya jua, vifaa vya elektroniki na EV kumechukua kiasi kikubwa cha metali halisi. Wakati wafanyabiashara wanapoanza kutumia usafiri wa anga ili kukidhi makataa ya uwasilishaji, inaashiria sio furaha iliyopitiliza bali uhaba.

Kwa nini ni muhimu

Kupanda kwa rekodi kwa dhahabu na fedha kunawasukuma wawekezaji kutathmini upya mawazo yao kuhusu usalama, ubadilishaji, na thamani. Baada ya muongo ambapo dhamana za serikali na hisa za teknolojia za Marekani zilitawala mazungumzo juu ya maeneo salama, metali za thamani zinarudi katika jukumu zilizocheza wakati wa mizunguko ya awali ya mvutano wa kijiografia na kisiasa na msongo wa kifedha. Kama UBS ilivyobainisha, “kuendelea kudhoofika kwa dola, mapato halisi ya chini na hatari inayoendelea ya kijiografia na kisiasa” kumeifanya dhahabu kuvutia hata wakati wa mabadiliko mafupi ya matumaini ya soko.

Kwa watunga sera, mkutano huo una ujumbe wa wazi: imani katika nidhamu ya kifedha na sera ya fedha ya muda mrefu inapungua. Kupanda kwa dhahabu kuelekea $4,400 kunaashiria wasiwasi kuhusu nakisi, kushuka kwa thamani ya sarafu na athari za miaka ya kurahisisha kiasi (quantitative easing). Benki kuu zenyewe zinaongeza akiba zao za dhahabu huku zikijitolea hadharani kwa malengo ya mfumuko wa bei - utata ambao masoko hayajapuuza. Kupanda kwa fedha kuna athari kwa kundi tofauti la wadau, kutoka kwa watengenezaji wa nishati mbadala hadi makampuni ya elektroniki, ambao wote wanategemea uwezo wa metali hiyo wa kupitisha umeme na matumizi ya kiviwanda yasiyo na kifani.

Utendaji bora wa fedha ni muhimu hasa kwa uchumi unaoibukia kama India, ambapo fedha halisi inabaki kuwa njia inayopendekezwa ya kuweka akiba kwa kaya. Mahitaji yanayohusiana na mila za kitamaduni, mizunguko ya mapato ya kilimo na misimu ya sherehe yameongezeka wakati usambazaji wa kimataifa unapoimarika. Shinikizo hilo limesukuma bei za ndani kufikia rekodi za juu, na kufanya fedha kuwa kimbilio salama na chanzo cha msongo wa kifedha.

Athari kwa masoko, viwanda na watumiaji

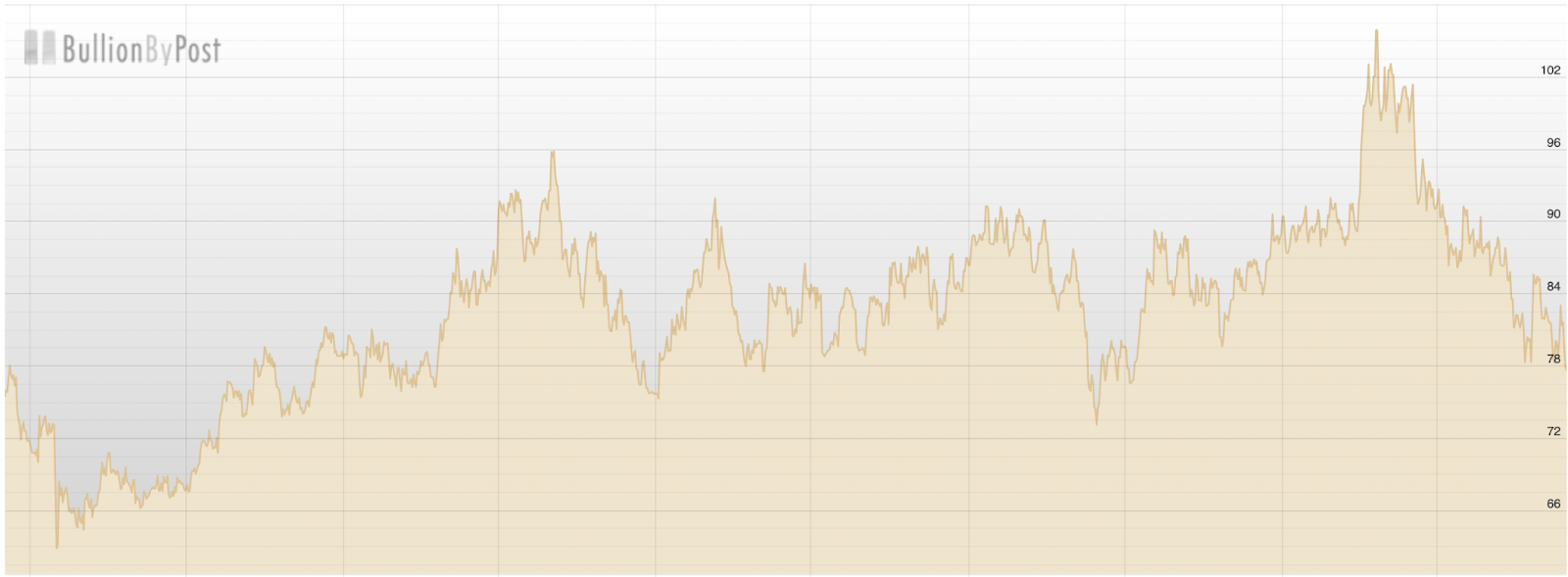

Masoko ya fedha tayari yanahisi athari za utawala huu mpya wa metali za thamani. Uwiano wa dhahabu-fedha, ambao ulianza mwaka 2025 juu ya 100, sasa umeshuka hadi karibu 75 wakati fedha inapoipita dhahabu kwa asilimia.

Uwiano bado uko juu ya wastani wake wa muda mrefu karibu 70, ikipendekeza nafasi inayoendelea kwa fedha kupata faida ikiwa dhahabu itatulia. Mabadiliko haya yamegeuza uwiano wenyewe kuwa ishara ya soko - kipimo cha jinsi wawekezaji wanavyozunguka kwa ukali katika kinga za beta ya juu.

Mtiririko wa ETF na masoko ya hatima (futures) yamezidisha hatua hizi. Wakati bei za papo hapo zinapopanda, ETF zinavutia mapato yanayoendeshwa na kasi, wakati nafasi za hatima zilizokopwa zinakuza kila ongezeko na marekebisho. Fedha inakabiliwa zaidi na mabadiliko makali kwa sababu soko la msingi ni dogo na nyeti zaidi kwa ufilisi wa lazima. Kwa wawekezaji wa rejareja, hii inaunda mchanganyiko wa fursa na hatari: fedha inaweza kutoa faida kubwa katika soko lenye nguvu lakini inaweza kupungua haraka wakati hisia zinapogeuka.

Uchumi wa viwanda unakabiliwa na shinikizo la moja kwa moja zaidi. Mahitaji ya fedha duniani kwa matumizi ya kiviwanda yaliongezeka hadi takriban aunsi milioni 680.5 mwaka 2024, kutoka karibu milioni 644 mwaka mmoja kabla. Uzalishaji wa paneli za jua pekee ulitumia makadirio ya aunsi milioni 244 - zaidi ya mara mbili ya viwango vya 2020. Pamoja na Shirika la Nishati la Kimataifa kukadiria gigawati 4,000 za uwezo mpya wa jua ifikapo 2030, mahitaji yanaweza kuongezeka kwa aunsi nyingine milioni 150 kila mwaka.

Magari ya umeme (EVs) yanaongeza mkazo zaidi. EV za sasa zinatumia gramu 25–50 za fedha kila moja, lakini miundo inayoweza kutokea ya betri za hali imara inaweza kuhitaji hadi kilo moja ya fedha kwa kila gari. Ikijumuishwa na ukuaji wa AI, semiconductor, na miundombinu ya vituo vya data, hii inaunda mahitaji endelevu wakati ambapo usambazaji wa migodi duniani umekuwa ukipungua kwa karibu muongo mmoja.

Watumiaji wanapata uzoefu huu kwa njia mbili. Kupanda kwa gharama za pembejeo kunaweza kutafsiriwa kuwa usakinishaji wa gharama kubwa zaidi wa nishati ya jua, magari ya umeme na vifaa vya elektroniki. Wakati huo huo, kaya katika masoko muhimu, kama vile India, zinaendelea kuona fedha kama hifadhi ya thamani inayoaminika. Bei huko zilifikia rupia 170,415 kwa kilo mnamo Oktoba, ongezeko la 85% tangu kuanza kwa mwaka - ishara ya imani na mzigo kwa wanunuzi.

Mtazamo wa wataalamu

Benki nyingi kuu sasa zinakusanya utabiri wao wa dhahabu wa 2026 kati ya $4,000 na $4,600. Deutsche Bank hivi karibuni ilipandisha makadirio yake ya wastani ya 2026 hadi karibu $4,450 na kuelezea kiwango cha biashara kati ya $3,950 na $4,950. Goldman Sachs inaona “karibu 20% ya ongezeko zaidi” kutoka viwango vya sasa, ikimaanisha njia kuelekea takriban $4,900 kwa aunsi mwishoni mwa 2026 ikiwa ununuzi wa benki kuu utaendelea na dola kudhoofika. Bank of America, HSBC, na Société Générale zote zinachukulia $5,000 kama lengo la kweli la juu.

Taasisi zenye tahadhari zaidi zinatarajia mkutano huo kutulia badala ya kuendelea. Benki ya Dunia inaonya kwamba, baada ya faida ya takriban 40% inayoendeshwa na uwekezaji mwaka 2025, bei za metali za thamani zinaweza kupanda kwa kiasi kidogo tu mwaka 2026, zikiakisi uimarishaji badala ya kuongeza kasi. Chini ya hali hii, dhahabu ingefanya biashara kwa upande katika anuwai pana, na fedha ingetulia katika viwango vya juu lakini visivyo na mabadiliko makali wakati usambazaji unapoitikia hatua kwa hatua.

Mtazamo wa fedha unabaki kuwa na mabadiliko zaidi kwa sababu ya jukumu lake mbili kama metali ya thamani na ya kiviwanda. Wachambuzi wanatarajia soko kubaki katika nakisi kwa mwaka wa tano mfululizo, lakini ukubwa mdogo wa fedha na unyeti mkubwa kwa mtiririko uliokopwa unaweza kusababisha kurudi nyuma kwa kasi ikiwa kupunguzwa kwa viwango kutakatisha tamaa au dola kuimarika. Kama Paul Syms wa Invesco alivyona, msukumo wa usambazaji wa mwaka huu “uliwashangaza wawekezaji wachache”, na fedha mara chache hurudia mwelekeo bila kupima pande zote mbili kwanza.

Katika metali zote mbili, vichocheo vinavyofuata ni wazi: mkutano wa Desemba wa Federal Reserve, utabiri mpya wa ukuaji wa dunia, na data mpya za akiba za benki kuu. Hizi zitaamua ikiwa hali za kifedha zitaendelea kurahisishwa hadi 2026 au ikiwa masoko yataanza kufungua baadhi ya biashara zenye nguvu zaidi za mwaka.

Jambo kuu la kuzingatia

Dhahabu na fedha zinavunja rekodi mwaka 2025 kwa sababu mahitaji ya kimataifa yanaongezeka wakati usambazaji unajitahidi kwenda sambamba. Benki kuu zinatafuta kinga dhidi ya hatari za kifedha na kijiografia, wawekezaji wanatamani uaminifu katikati ya kutokuwa na uhakika wa sera, na viwanda vinahitaji metali zinazoendesha mabadiliko ya nishati. Shinikizo hizi zimegongana na kuunda moja ya mikutano yenye nguvu zaidi ya metali za thamani katika miongo kadhaa. Sura inayofuata inategemea maamuzi ya viwango vya riba, mwelekeo wa mahitaji ya kiviwanda na uimara wa ununuzi wa benki kuu wakati dunia inapoingia 2026.

Ufahamu wa kiufundi wa Fedha

Mwanzoni mwa uandishi, Fedha (XAG/USD) imepanda hadi eneo la ugunduzi wa bei, ikifanya biashara juu ya $57 baada ya mlipuko mkali kutoka kwa uimarishaji. Hatua hiyo inaashiria ushawishi mkubwa wa kupanda kwa bei, na kasi ikibeba bei mbali zaidi ya anuwai ya awali. Viwango vya usaidizi vya mara moja sasa viko $50.00 na $46.93, viwango ambapo kurudi nyuma kunaweza kusababisha ufilisi wa kuuza na shinikizo la kina la kurekebisha ikiwa vitavunjwa.

Bei inabaki imepanuliwa kando ya Bollinger Band ya juu, ikiakisi maslahi makali ya ununuzi na soko linaloelekea kwa nguvu kwa upande wa wanunuzi. Kuzama kote kuelekea bendi ya kati kunaweza kutumika kama jaribio la kwanza la nguvu ya mwelekeo.

RSI inashikilia karibu 80, ikipanda lakini karibu tambarare ndani ya eneo la kununuliwa kupita kiasi. Hii inaonyesha wanunuzi wanabaki na udhibiti thabiti, lakini hatari ya kupoa kwa muda mfupi au uimarishaji wa upande inaongezeka. Wakati mwelekeo mpana uko juu kwa uamuzi, hali zilizopanuliwa kupita kiasi zinamaanisha wafanyabiashara wanapaswa kuangalia ishara za uchovu wakati fedha inapopita viwango vya juu visivyojulikana.

Takwimu za utendaji zilizotajwa sio dhamana ya utendaji wa baadaye.