Why a Wall Street legend says prices are ‘almost guaranteed’ to drop 50% while Citi targets $150

Silver hasn’t just rallied, it has erupted, soaring nearly 3x in a year and smashing through $100/oz, even as one of Wall Street’s most famous strategists warns the metal is “almost guaranteed” to drop about 50% from here. Former JPMorgan chief strategist Marko Kolanovic says silver’s parabolic move is a classic speculative blow-off.

How extreme is the silver rally?

Over the past year, silver has rocketed from the low‑30s to record intraday highs around $115–$118 per ounce, delivering roughly a 250–270% gain and outpacing gold and most major equity benchmarks.

Citi notes that the surge has already pushed silver to an all‑time intraday high near $117.7, compressing the gold‑to‑silver ratio below 50 and underscoring how violently the trade has shifted in silver’s favour. For context, the last major spike in 2011 stalled near $50 before a bruising multi‑year bear market, making today’s price level unprecedented in nominal terms.

Analysts note that this move has turned silver from a sleepy precious metal into a headline‑grabbing momentum asset, with intraday swings measured in double‑digit percentages. Such volatility is typical of the late stages of commodity booms, where marginal flows and sentiment, not slow‑moving fundamentals, dominate price action.

The bear case: Kolanovic’s “almost guaranteed” 50% crash

Kolanovic’s warning is blunt: he says silver is “almost guaranteed to drop ~50% from these levels within a year or so,” arguing that the current spike bears all the hallmarks of a speculative bubble.

He points to heavy momentum buying, meme‑style trading behavior, and macro‑fear positioning as key drivers, rather than durable improvements in underlying fundamentals. In his view, silver is trading less like a traditional store of value and more like a leveraged macro instrument that can overshoot violently in both directions.

The logic is grounded in history: commodities that go parabolic rarely plateau smoothly; they tend to mean‑revert hard as positioning unwinds and marginal buyers disappear. The 2011 silver bust and the wild boom‑bust cycles of the 1970s are often cited examples where deep drawdowns followed euphoric peaks without necessarily ending longer‑term secular themes.

Kolanovic underscores that, unlike purely fictional assets, commodity bubbles eventually collide with physical reality as high prices destroy industrial demand, accelerate recycling, and incentivise new hedged supply.

The bull case: Citi’s $150 target and “gold on steroids”

On the other hand, Citi’s commodities team has become tactically more bullish, raising its 0–3 month silver price target to $150 per ounce, implying another 30–40% upside from recent levels. Citi’s Maximilian Layton writes, “We remain tactically bullish and upgrade our 0–3m point price target to $150/oz,” framing silver’s current behaviour as “gold squared” or “gold on steroids” as capital flows chase macro hedges.

The bank argues that the rally is being driven primarily by capital flows and speculative demand rather than traditional fundamentals, but believes those flows still have room to run before the market looks expensive relative to gold.

Citi highlights three main supports: heightened geopolitical risks, renewed concerns over Federal Reserve independence, and strong investment and speculative demand led by Chinese and other Asian investors.

Reporting on the call notes that physical supply outside the United States looks tight, with high premiums in key markets and persistent deficits expected in the coming years. In this framework, silver is expected to overshoot higher before any major normalisation, especially if trend‑following retail flows in China and elsewhere continue to pile into the trade.

Industrial demand, solar, and the substitution risk

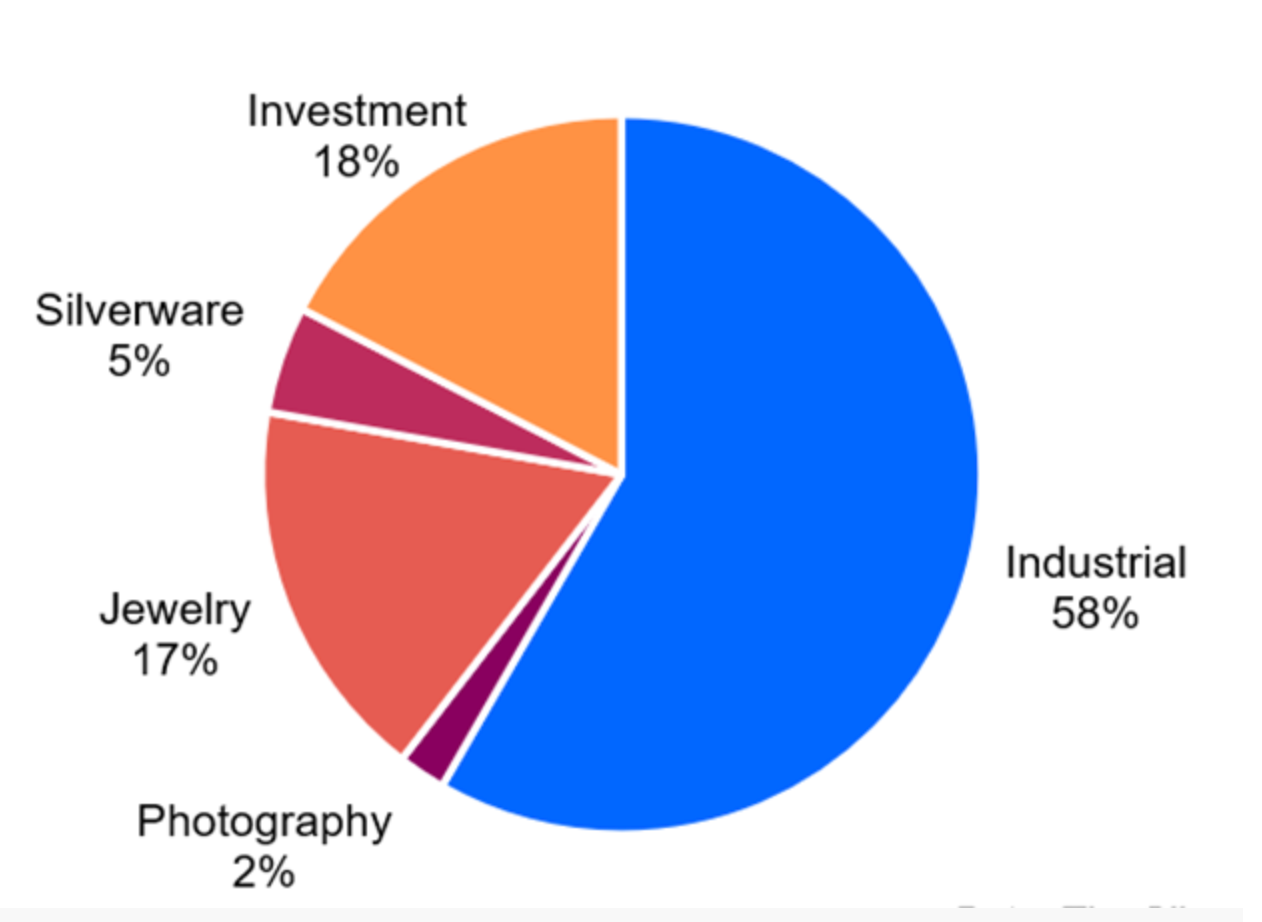

Beneath the speculative froth, silver remains a workhorse industrial metal: industrial applications now account for roughly 58% of global silver demand, with renewable energy, electronics, and automotive uses especially important.

The Silver Institute and Metals Focus expect industrial demand to reach about 700 million ounces, driven largely by photovoltaics, where silver’s conductivity makes it critical for solar cells. Recent estimates suggest solar alone could represent around 19–20% of total silver demand in 2024, roughly 230 million ounces, and that solar demand has almost doubled versus 2022.

At the same time, high prices are already accelerating “silver thrifting” and substitution by cheaper base metals in some applications. Industry reports describe leading module manufacturers such as LONGi working to cut silver loadings in their solar cells, exploring copper‑based metallisation and other innovations to reduce cost exposure.

This creates a tension: structurally tight supply and booming green‑economy demand support the bull case, but very high prices also sow the seeds of future demand destruction and substitution - exactly the dynamic Kolanovic warns about.

Positioning, ETFs, China and the new momentum trade

This silver rally looks different from previous cycles because the speculative center of gravity sits elsewhere. Citi observes that several historically bearish signals - such as falling global silver ETF holdings and declining COMEX positioning - have failed to slow prices, indicating that much of the buying is coming from Asian futures and OTC markets rather than Western ETFs.

Coverage of the move notes that Chinese retail traders have been key players, prompting authorities to tighten conditions, including raising futures margins and limiting new subscriptions to a major domestic silver ETF.

Western vehicles like iShares Silver Trust, Aberdeen Standard Physical Silver, and Sprott Physical Silver Trust remain important gateways for macro and retail investors, but they no longer appear to be the main marginal drivers of this latest leg higher.

Kolanovic’s warning explicitly frames silver ETFs as crowded macro trades at risk of a sharp positioning unwind, while bearish ETF‑focused products have emerged to let investors position against what some call a “parabolic mania.” Both camps, bull and bear, implicitly agree on one crucial point: positioning is extreme, and any shift in flows could translate into very large moves in either direction over a short period.

What a 50% drawdown or a spike to $150 could mean

Market watchers noted that if Kolanovic is right and silver trades at roughly half its recent price by late 2026, a move from around $110–$115 to the $50–$60 range would inflict heavy losses on late‑cycle buyers, leveraged traders, and higher‑cost miners. Such a drawdown would be painful but not historically unprecedented when measured against prior busts in silver and other commodities. It could also relieve some pressure on industrial users and accelerate a rebalancing where thrifting and substitution slow, demand stabilises and the metal potentially builds a base for the next secular leg higher.

If Citi’s tactical bull case plays out instead, a spike to $150 would further compress the gold–silver ratio and cement silver’s status as the high‑beta expression of macro fear and liquidity.

However, such levels would likely intensify policy responses in key markets - through tighter margin rules, curbs on speculative access or other measures - and turbo‑charge efforts in solar and electronics to engineer silver out of as many applications as possible. Citi itself cautions that, while the medium‑ to long‑term supply‑demand balance looks tight, short‑term volatility could increase after such a sharp run‑up.

Key takeaway

Silver now sits at an inflection point between momentum and mean reversion. On one side, Citi sees powerful macro flows, tight physical supply, and speculative demand pushing prices as high as $150 in the near term. On the other, Marko Kolanovic warns that history rarely treats parabolic commodity moves kindly, with a 50% drawdown a familiar outcome once positioning unwinds and high prices start to destroy demand.

For traders and investors, the message is clear: silver may still have upside, but it is no longer a quiet inflation hedge - it is a high-volatility, high-conviction macro trade where timing and risk management matter more than ever.

Silver technical outlook

Silver has continued to move higher into new price territory, tracking the upper Bollinger Band as volatility remains elevated. The Bollinger Bands are widely expanded, indicating a sustained high-volatility environment following the recent acceleration.

Momentum indicators show extreme readings, with the RSI in overbought territory and the ADX at elevated levels, reflecting a strong, mature trend phase. From a structural perspective, current prices sit well above earlier consolidation areas around $72, $57, and $46.93, illustrating the scale of the recent move.

The performance figures quoted are not a guarantee of future performance.