What comes next for the Magnificent 7 after the Fed’s pause

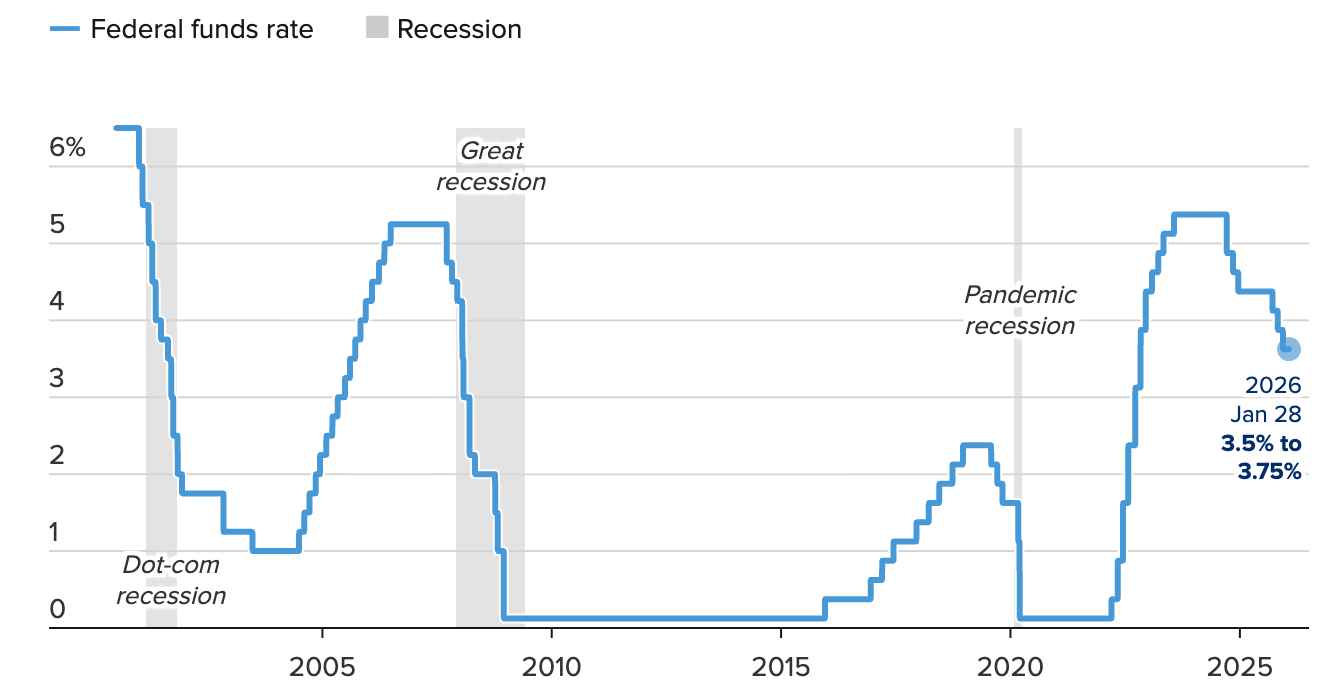

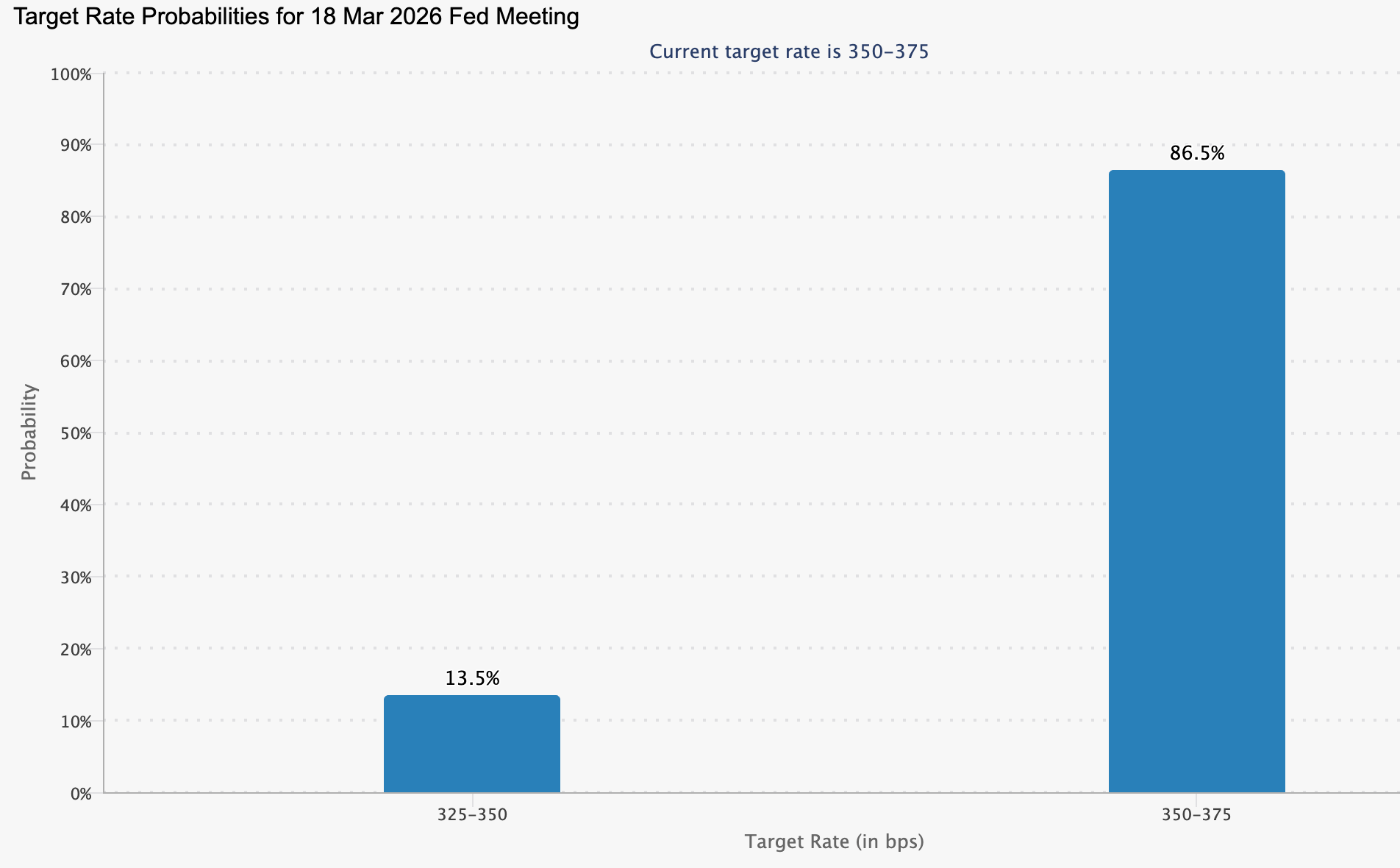

What comes next for the Magnificent 7 is no longer about whether growth continues, but how much investors are willing to pay for it. The Federal Reserve’s decision to pause rates at 3.50–3.75%, after cutting 175 basis points since September 2024, removes a key macro tailwind that has quietly supported big tech valuations over the past year.

With inflation still described as “somewhat elevated”, the message was clear: policy support is on hold. That pause arrives just as Microsoft, Meta, and Tesla have laid bare the true cost of leading the AI revolution.

Earnings beat expectations, but capital spending surged, margins came under scrutiny, and markets responded with caution rather than celebration. The next phase for the Magnificent 7 will be decided less by innovation headlines and more by execution, discipline, and returns.

What’s driving the magnificent 7?

At the macro level, the Fed’s stance has shifted the investment backdrop. Policymakers signalled confidence in economic momentum heading into 2026, noting stabilising unemployment and inflation that remains above target. Two dissenting votes for a modest 25-basis-point cut reflected debate, not urgency. For equity markets, that suggests interest rates may stay restrictive for longer, raising the bar for growth stocks.

At the corporate level, artificial intelligence continues to dominate strategy. Microsoft’s capital expenditure jumped 66% year-on-year to $37.5 billion, while Meta raised its fiscal 2026 capex outlook to as high as $135 billion. These figures reflect a structural shift rather than a short-term cycle. AI is no longer an optional growth lever; it is core infrastructure that demands sustained investment regardless of market sentiment.

Why it matters

The reaction to earnings revealed an important change in market behaviour. Microsoft delivered strong headline numbers, with earnings of $4.14 per share beating expectations, yet its shares fell in after-hours trading. Azure revenue came in slightly below consensus, and investors fixated on ballooning AI commitments rather than near-term profits.

That response underlines a broader theme: markets are becoming less forgiving. “The AI build-out phase is now priced in. What investors want to see is monetisation,” said Wedbush analyst Dan Ives, warning that capital discipline will increasingly differentiate winners from laggards. For the Magnificent 7, scale alone is no longer enough to command premium valuations.

Impact on markets and the AI ecosystem

Recent data showed that the immediate market impact was uneven. The Nasdaq stalled just below record highs, while Dow futures dipped amid Microsoft's weight on the index. Nvidia, often viewed as the purest AI proxy, edged lower in extended trading despite remaining technically strong, suggesting consolidation rather than capitulation.

Beyond equities, the ripple effects were visible elsewhere. Gold and silver prices rose as investors hedged against valuation risk and policy uncertainty, while crude oil gained on expectations that data centre expansion will drive sustained energy demand. The Magnificent 7’s decisions are now influencing capital flows well beyond the technology sector.

Expert outlook

Looking ahead, market watchers expressed that the next phase for the Magnificent 7 hinges on whether AI investment begins to translate into durable profitability. Tesla’s results illustrated this tension. While earnings exceeded expectations, revenue fell short, and the company outlined plans to exceed $20 billion in capital spending in 2026, more than double last year’s level. Ambition remains high, but investors' patience may not be unlimited.

Key signals will arrive over the coming weeks. Nvidia’s earnings will test whether AI demand continues to justify current valuations, while upcoming inflation data will shape expectations for the March 17–18 FOMC meeting.

With rates on hold and capital costs rising, the Magnificent 7 are entering a phase where returns, not narratives, will drive performance.

Key takeaway

The Fed’s pause has shifted the conversation around the Magnificent 7 from momentum to sustainability. AI growth remains powerful, but the cost of leadership is rising fast. Investors are beginning to ask tougher questions about returns on capital. What comes next will depend on whether earnings can justify the scale of ambition in a higher-for-longer rate environment.

The performance figures quoted are not a guarantee of future performance.