Agentes de pago

Versión:

R25|04

Última actualización:

February 10, 2025

Tabla de contenido

Aquí encontrará los términos y condiciones que se aplican específicamente a nuestros agentes de pago. Estos términos y condiciones deben leerse junto con los Términos generales para socios comerciales (los "Términos generales"). Los términos definidos utilizados en estas condiciones tendrán el significado que se les atribuye en los Términos generales.

1. Prestación de servicios

1.1. Si aceptamos su solicitud para convertirse en agente de pagos, podrá prestar servicios para facilitar la transferencia de fondos o pagos hacia y desde cuentas Deriv para nuestros clientes (los "Servicios de pago").

1.2. No proporcionará Servicios de pago a ningún cliente que resida en un país en el que no aceptemos clientes ni ofrezcamos nuestros servicios. Contáctenos en [email protected] si necesita más información.

1.3. Conforme a la cláusula 1.2, usted podrá prestar Servicios de pago a nuestros clientes que deseen depositar o retirar dinero en el sitio web de Deriv y que deseen utilizar métodos de pago que no figuren entre las opciones enumeradas en nuestro sitio web. Si desea ofrecer sus Servicios de pago a clientes que residen fuera de la jurisdicción en la que opera, debe solicitar y obtener nuestra autorización enviando un correo electrónico a [email protected] o a través del Live Chat.

1.4. Deberá asegurarse de que cada cliente deposite fondos con nosotros a través de sus Servicios de pago de acuerdo con los siguientes pasos:

1.4.1. El cliente deposita fondos con usted, utilizando un método de pago acordado entre el cliente y usted;

1.4.2. Reciba el monto depositado y realice un depósito igual de fondos en su cuenta de agente de pago; y

1.4.3. Transfiera el monto depositado desde su cuenta de agente de pago a la cuenta de Deriv del cliente.

1.5. Deberá asegurarse de que cada cliente realice un retiro a través de sus Servicios de Pago de acuerdo con los siguientes pasos:

1.5.1. El cliente solicita un retiro de fondos de su cuenta de Deriv.

1.5.2. Transferimos automáticamente la suma solicitada para el retiro desde la cuenta de Deriv del cliente a la cuenta de su agente de pagos. Si, por cualquier motivo, la cuenta del cliente requiere autenticación, la solicitud de retirada no se tramitará hasta que se haya completado el proceso de autenticación requerido; y

1.5.3. Usted transfiere la cantidad solicitada al cliente utilizando el método de pago que haya acordado con él.

1.6. Nos reservamos el derecho de suspender o terminar sus Servicios de pago y/o su cuenta de Deriv en caso de disputas no resueltas, quejas y abuso de nuestros servicios si usted es responsable.

2. Política de incorporación

2.1. Entiende que en su solicitud para convertirse en Agente de pago, debe incluir la siguiente información:

2.1.1. Nombre, dirección de correo electrónico, y número de contacto;

2.1.2. Prueba de identidad y comprobante de domicilio;

2.1.3. URL del sitio web (si corresponde);

2.1.4. El nombre de su agente de pagos (tenga en cuenta que los caracteres especiales y las palabras "Deriv" o "Binary" no pueden formar parte del nombre de su agente de pagos);

2.1.5. Una lista de métodos de pago aceptados;

2.1.6. Las comisiones que se cobrarán por depósitos y retiros; y

2.1.7. Cualquier otra información que podamos solicitar de vez en cuando.

Debe enviar esta información a [email protected].

2.2. Si su solicitud es aceptada, usted acepta que la información que proporcione (incluyendo, entre otros, su nombre, dirección, URL del sitio web (si procede), dirección de correo electrónico, número de teléfono, tarifas de comisión y métodos de pago preferidos) pueda ser divulgada en nuestro(s) sitio(s) web.

2.3. Nos reservamos el derecho a modificar los requisitos de las transacciones entre su cuenta de agente de pagos y las cuentas de los clientes.

3. Derechos y obligaciones

3.1. Nos reservamos el derecho de retirar su estatus de Agente de pago si no cumple con nuestros requisitos de volumen de transacciones.

3.2. Su solicitud para convertirse en Agente de pago solo se revisará si tiene una cuenta de Deriv con un saldo igual o superior al monto mínimo requerido para su país de residencia.

3.3. Para cumplir con el requisito del apartado 3.2 anterior, usted podrá depositar la cantidad requerida utilizando cualquier método de pago, incluidos los servicios de otro agente de pago, con la excepción de Deriv P2P y tarjetas de crédito o débito.

3.4. Deberá actuar con la debida diligencia con sus clientes. Podemos solicitarle en cualquier momento que nos facilite toda la información y documentación relacionada con sus clientes a efectos de cumplir con las leyes, reglamentos o normas contra el blanqueo de capitales o la financiación del terrorismo a los que estamos sujetos.

3.5. Usted es responsable de garantizar que todos los fondos depositados en su cuenta de agente de pagos en relación con los depósitos o retiradas que un cliente realice a través de usted (tal y como se describe en la cláusula 1) se transfieran a la cuenta de Deriv correcta para ese cliente.

3.6. Debe incluir un aviso legal visible y permanente en su plataforma promocional (por ejemplo, sitio web, páginas de redes sociales, boletín informativo por correo electrónico) en el que se indique lo siguiente:

"Deriv no está afiliado a ningún agente de pago. Los clientes tratan con los agentes de pago bajo su propio riesgo. Se recomienda a los clientes que verifiquen las credenciales de los agentes de pago y la exactitud de cualquier información relacionada con ellos (en Deriv.com o en otro lugar) antes de utilizar sus servicios."

Si existen limitaciones de caracteres, puede usar la siguiente versión abreviada en su lugar:

"Deriv no tiene afiliación con agentes de pago. Los clientes son los únicos responsables de verificar sus credenciales y cualquier información relacionada antes de interactuar con ellos".

El hecho de no mostrar este aviso legal de forma destacada y continua puede dar lugar a la cancelación de su condición de agente de pago.

3.7. No podrá realizar retiradas de su cuenta de agente de pagos ni a través de Deriv P2P, salvo que hagamos una excepción a nuestra entera discreción.

3.8. No podrá utilizar su cuenta de agente de pagos para operar bajo ninguna circunstancia.

3.9. No podrá transferir fondos desde su cuenta de agente de pago a otro agente de pago, salvo que hagamos una excepción a nuestra entera discreción.

4. Agente de Pago Premium

4.1. La concesión y revocación de la condición de agente de pago "premium" queda a la entera discreción de la empresa.

4.2. La condición de agente de pago "premium" le da derecho a realizar algunas funciones adicionales que definimos a continuación.

1. Introducción

Esta guía está diseñada para ayudarle a promocionar Deriv de manera ética y efectiva. Al cumplir estas normas, podrá ganarse la confianza de sus clientes y representar los valores de Deriv. Por favor, lea esta guía con atención. Si no cumple estas normas, es posible que tengamos que poner fin a nuestra colaboración. Si tiene preguntas o necesita ayuda, contacte con el administrador de su cuenta.

2. Directrices de la marca

Muestre siempre la frase "Powered by" encima o antes del logotipo de Deriv en su sitio web y en cualquier aplicación móvil que cree.

Comunique claramente su relación con Deriv. Use frases como "en colaboración con Deriv" y "en asociación con Deriv" o preséntese como afiliado de Deriv.

No tiene permiso para crear grupos o canales utilizando el nombre y el logotipo de Deriv. En su sitio web y plataformas, no puede:

- Copiar secciones enteras de contenido del sitio web de Deriv.

- Mencione las regulaciones de Deriv y los detalles del regulador.

- Utilizar datos o imágenes de empleados de Deriv del sitio web de Deriv.

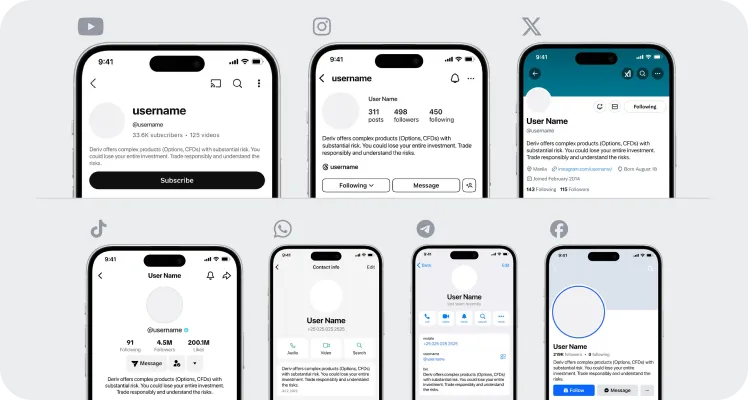

3. Crear su presencia en línea

Conserve su propio estilo. Evite utilizar la misma combinación de colores que Deriv o nombres que se parezcan o suenen como Deriv.

Desarrolle su presencia en línea única como socio de Deriv. Esto puede ser a través de su propio sitio web o de atractivas plataformas de redes sociales. Por ejemplo, puede crear videos que guíen a los clientes sobre cómo empezar con Deriv o cómo hacer trading.

Asegúrese de que sus nombres de usuario en las redes sociales y los dominios de sus sitios web sean únicos.

Nunca use ni incluya el nombre de la empresa Deriv en su nombre de usuario.

4. Normas de marketing y publicidad

Antes de promocionar Deriv a través de anuncios de pago en plataformas como Facebook o Google, envíe una solicitud a su gestor de cuentas o por correo electrónico a [email protected]. Incluya el texto del anuncio, los materiales creativos (videos/imágenes), las palabras clave y la página de destino.

No puje por palabras clave de marca en campañas de búsqueda pagadas en motores de búsqueda (por ejemplo, Google y Bing).

Palabras clave no permitidas: deriv, deriv app, deriv broker, dtrader, deriv trading, deriv live account, deriv trader, deriv virtual account, bot trading deriv, deriv.com, www.deriv.com, deriv.com login, deriv mt5 trading, trading automatizado deriv, deriv register, deriv cfd trading, trading automatizado deriv.

- Utilice los materiales de marketing disponibles en su panel de control de afiliado para promocionar Deriv. Si quiere crear sus propios materiales de marketing, asegúrese de utilizar las advertencias de riesgo adecuadas.

- No sobrescriba, edite ni manipule los materiales de marketing proporcionados por Deriv. No se debe difuminar nada y la fuente debe mantenerse igual.

5. Prácticas promocionales

- Planifique sus campañas de promoción cuidadosamente, para que sus publicaciones no aparezcan como spam.

- Evite enviar spam a plataformas de redes sociales, grupos, correos electrónicos o sitios web con su enlace de afiliado.

- Promocione Deriv de manera adecuada en plataformas legítimas de redes sociales como YouTube, Facebook, Instagram, X y Telegram.

- No utilice anuncios emergentes ni promociones en sitios web ilegales para promocionar su enlace de afiliado.

6. Comunicación y transparencia

Defina claramente los servicios que está promocionando. Asegúrese de que quede claro que está promocionando una plataforma de trading y no un casino o un plan para enriquecerse rápidamente. Por ejemplo, no puede representar a Deriv o a sus productos y servicios como:

- Un producto de lujo

- Una plataforma de dinero fácil

- Una oportunidad de inversión

- Cualquier cosa que garantice ingresos o ganancias

Incluya el siguiente descargo de responsabilidad de riesgo en un lugar destacado (ya sea en el encabezado o en el pie de página de su sitio web, en una fuente y tamaño de fuente legibles):

- “Deriv ofrece productos complejos, incluidas opciones y CFD, que conllevan riesgos significativos. El trading con CFD implica apalancamiento, lo que puede amplificar tanto las ganancias como las pérdidas, lo que puede llevar a la pérdida de toda su inversión. Opere solo con dinero que pueda permitirse perder y nunca pida prestado para operar. Comprenda los riesgos antes de operar".

Incluya la siguiente exención de responsabilidad de riesgo en sus perfiles de redes sociales y colóquela como imagen de banner, en la biografía o como publicación fijada:

- “Deriv ofrece productos complejos (opciones, CFD) con un riesgo sustancial. Podría perder toda su inversión. Opere de manera responsable y entienda los riesgos".

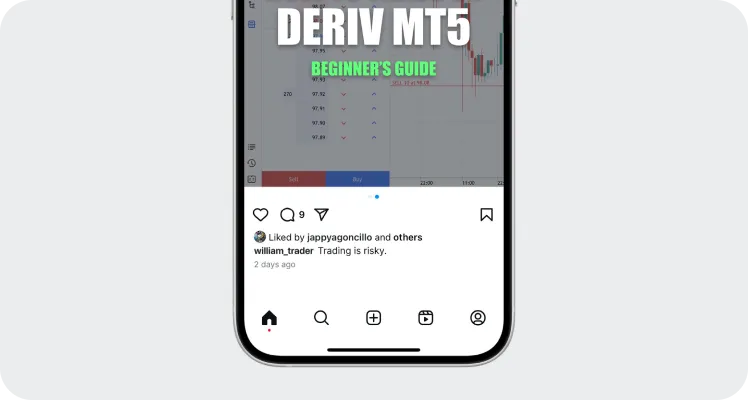

Añada siempre uno de los siguientes descargos de responsabilidad de riesgo a sus publicaciones en redes sociales relacionadas con Deriv:

- “Operar es arriesgado.”

- “No es asesoramiento de inversión. Operar con opciones puede que no sea adecuado para todo el mundo.”

7. Respeto de la privacidad

- Siempre pida permiso antes de tomar fotos o videos del personal de Deriv en cualquier evento.

- Nunca comparta fotos, videos o llamadas grabadas de eventos en los que participe el personal de Deriv sin permiso explícito por escrito.

8. Conclusión

Seguir estas directrices le ayudará a crear una presencia en línea respetable como afiliado de Deriv, y fomentará la confianza entre sus clientes y mejorará sus estrategias promocionales. Nuestra asociación se basa en el respeto mutuo y el cumplimiento de estas normas. Si tiene alguna pregunta o necesita ayuda, no dude en contactar a su gerente de cuentas.