Strong debut for Spot Ethereum ETFs: A step forward after SEC ETF approval

The newly launched spot Ethereum (ETH) exchange-traded funds (ETFs) made a significant impact on their first trading day, signalling another milestone for cryptocurrency’s mainstream acceptance. According to Bloomberg, these ETFs saw nearly $600 million in trading volume during the first half of the day and closed with over $1 billion worth of shares traded, demonstrating strong investor interest.

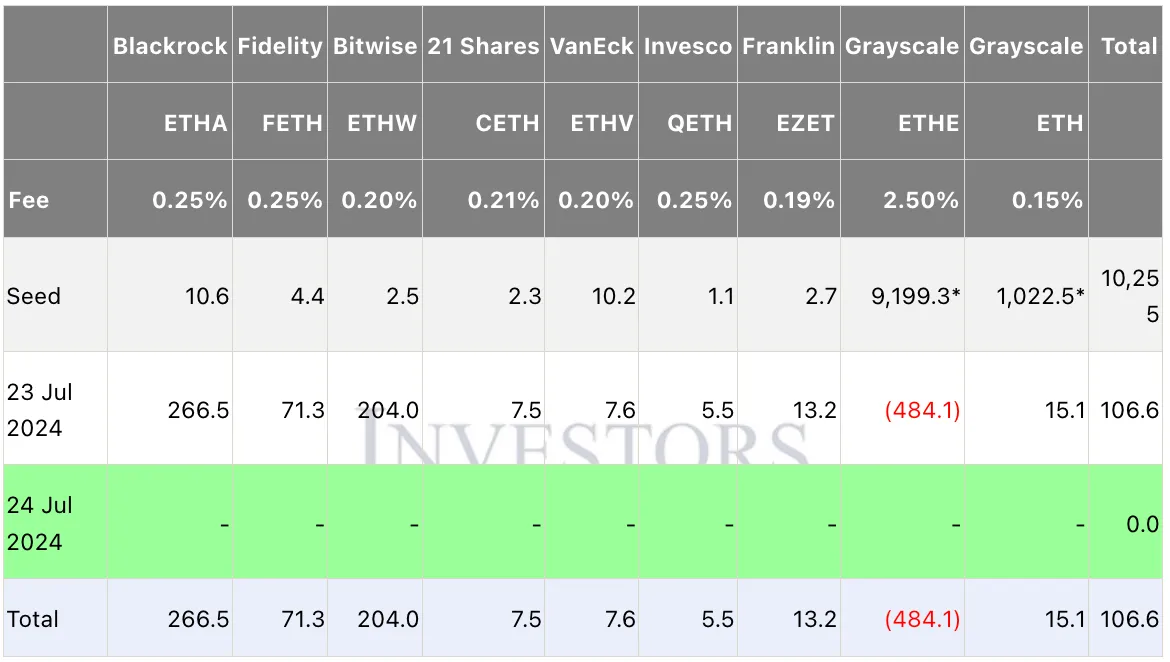

Ethereum ETFs performance after launch

BlackRock’s iShares Ethereum Trust ETF (ETHA) emerged as the ETF frontrunners, with $266.5 million worth of shares traded. This was followed by Bitwise’s Ethereum ETF (ETHW) at $204 million. Fidelity Ethereum Fund ETF (FETH) also performed well, with $71.3 million in trade volume.

Understanding the numbers

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, noted that the high trading volume for Grayscale’s ETHE might be largely due to outflows, as it entered the market with over $9 billion in assets. This mirrors the strategy seen with Grayscale’s Bitcoin Trust (GBTC), indicating significant investor activity focused on repositioning assets.

On the lower end, ETFs from Invesco and 21 Shares struggled to reach the $10 million mark in trading volume within the first four hours, highlighting a varied landscape of investor interest.

ETH spot ETF analyst projections

James Seyffart, another analyst from Bloomberg Intelligence,also made his ETH ETFs projections, predicting they could reach around $940 million in trading volume by the end of the first day (a figure that has now been surpassed). While impressive, that figure was only about 20% of the volume that spot Bitcoin ETFs saw on their debut day. Analysts have long anticipated that Ethereum ETFs would attract less interest than Bitcoin ETFs, attributing this to factors such as lower name recognition and the inability to stake the cryptocurrency through these funds.

Markus Thielen, founder of 10x Research, emphasised the importance of the funding rate in this context. When Bitcoin ETFs launched, Bitcoin’s funding rate was around 15% and surged to 70% in February, attracting institutional arbitrage funds that bought ETFs and shorted futures to profit from the spread. This activity drove a bullish sentiment. In contrast, Ethereum’s current funding rate is significantly lower at 7% to 9%, which, combined with current interest rates at 5%, makes it less attractive for similar arbitrage investments.

A significant milestone for the crypto market

Despite these challenges, analysts foresee the launch of spot Ethereum ETFs marks a significant step forward for the cryptocurrency market. It enhances the market’s legitimacy and contributes to its stability. Cristiano Ventricelli, senior analyst of digital assets at Moody’s Ratings, highlighted that these ETFs would help reduce volatility and provide a more stable investment environment.

Grzegorz Drozdz, a market analyst at investment firm Conotoxia Ltd., noted that while the inflows might not match those of Bitcoin ETFs, the introduction of Ethereum ETFs represents crucial progress in developing the cryptocurrency market . This sentiment was echoed by many industry experts who view the classification of ether as a commodity—rather than a security—as a positive development especially for etf trading.

According to experts, the long-term success of Ethereum ETFs could hinge on various factors, including investor demand and regulatory developments. Matteo Greco, research analyst at Fineqia International, pointed out that the demand for these ETFs would be essential in gauging investor appetite for digital assets beyond Bitcoin.

Analysts also note that one major issue for potential traders is the SEC’s exclusion of the staking mechanism in these ETFs — a critical feature of the Ethereum blockchain that allows users to lock up their tokens for a certain period to earn a yield. As currently constructed, the ETFs can only hold regular, unstaked ether, which may limit their appeal.

The approval process for these ETFs began in September, with issuers initially uncertain about SEC approval. However, the agency’s unexpected decision in May, influenced by a court ruling in favour of Grayscale, paved the way for these products. SEC Chair Gary Gensler mentioned that the ruling had impacted his thinking regarding the approval of Ethereum ETFs, noting similar underlying market conditions.

Technical outlook for ETH/USD: Could a rebound be in the offing?

At the time of writing, sellers appear to be vying for control as ETH/USD prices hover around the $3,170 mark. The weekly chart shows that bulls remain active, with prices still above the 100 EMA. The RSI is flat, just below 60, suggesting that the bullish pressure observed in previous weeks could be pausing. Sellers may find support at the $2,890 psychological level, an area that has held before, as seen on the weekly chart, with a significant drop likely finding support at the $2,400 mark. Conversely, a rebound could face resistance at $3,370, with further upward movement likely capped at $3,400.

Spot ETF approval: A step in the right direction

Investors and traders alike note that the debut of spot Ethereum ETFs represents a critical advancement for the cryptocurrency market, underscoring the growing acceptance and integration of digital assets into mainstream financial markets. While they may not replicate the immediate success of Bitcoin ETFs, these products signify an important step in the evolution and legitimacy of the cryptocurrency industry. As the market continues to develop, the performance and adoption of these ETFs will be closely watched by investors and analysts alike.

As for now, you can get involved and speculate on CFDs with a Deriv MT5 account. It offers a list of technical indicators that can be employed to analyse prices. Log in now to take advantage of the indicators, or sign up for a free demo account. The demo account comes with virtual funds so you can practise analysing trends risk-free.

Disclaimer:

The information contained within this blog article is for educational purposes only and is not intended as financial or investment advice. This information is considered accurate and correct at the date of publication. No representation or warranty is given as to the accuracy or completeness of this information.

The performance figures quoted refer to the past, and past performance is not a guarantee of future performance or a reliable guide to future performance. Changes in circumstances after the time of publication may impact the accuracy of the information.

Trading is risky. We recommend you do your own research before making any trading decisions.

.webp)