Bitcoin price prediction: Is this whipsaw week setting up the next breakout toward $120K?

After a week of sharp reversals that punished both bulls and bears, analysts say Bitcoin’s rebound to $111,000 could be the early stage of a breakout toward $120,000 supported by a shift in whale positioning, easing macro conditions, and renewed risk appetite. While volatility remains elevated, on-chain and institutional signals suggest the recent whipsaw action may be less about confusion - and more about quiet accumulation ahead of the next move higher.

Key takeaways

- Bitcoin rebounds to $111K after falling below $107K midweek, forming a classic whipsaw pattern.

- Whales are closing short positions worth hundreds of millions, signalling a potential trend reversal.

- Miners are decoupling from Bitcoin prices, pivoting toward AI infrastructure for more stable returns.

- Mid-sized holders continue to accumulate, reinforcing the long-term bullish structure.

- Markets expect two more Fed rate cuts in 2025, with macro conditions favouring risk assets.

- Reclaiming $112K could confirm a new uptrend, while CPI data remains the next major catalyst.

Bitcoin’s volatile setup: Chaos or the start of a new trend?

Bitcoin’s rollercoaster week saw it plunge below $107,000 on Wednesday before rebounding above $111,000 by Thursday. This sharp back-and-forth - known as a whipsaw pattern - typically shakes out trend-followers who buy rallies and sell dips too late.

The move coincided with a U.S. presidential pardon for Binance founder Changpeng “CZ” Zhao, a development viewed as a regulatory green light for crypto markets. Gains in U.S. equities, especially the Nasdaq’s 1% rise, further lifted sentiment ahead of Friday’s crucial Consumer Price Index (CPI) report. Despite the volatility, Bitcoin’s ability to recover above the $111,000 level indicates underlying strength.

For traders using tools like Deriv MT5, these sharp reversals highlight the importance of flexible position sizing and timely stop-loss management during high-volatility periods.

Bitcoin whale activity: Whales flip from shorts to longs

The biggest signal comes from the whales - major Bitcoin holders who often move early.

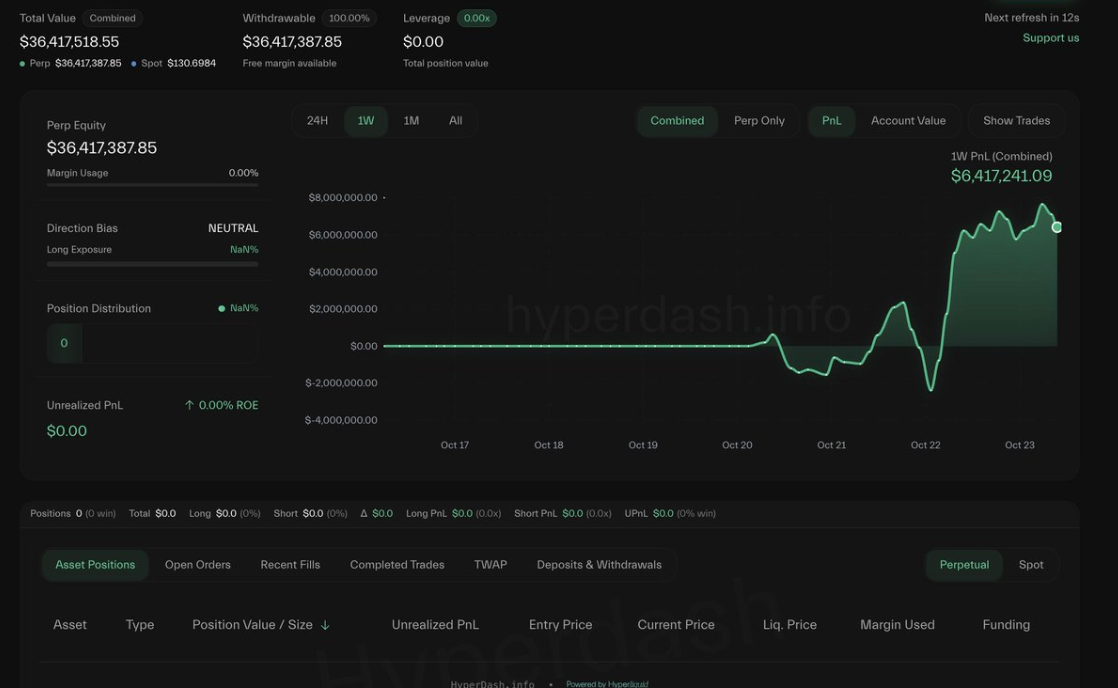

On-chain data from Lookonchain revealed that whale “Bitcoin OG” closed a 2,100 BTC short position worth $227.8 million, netting $6.4 million in profit before flipping long.

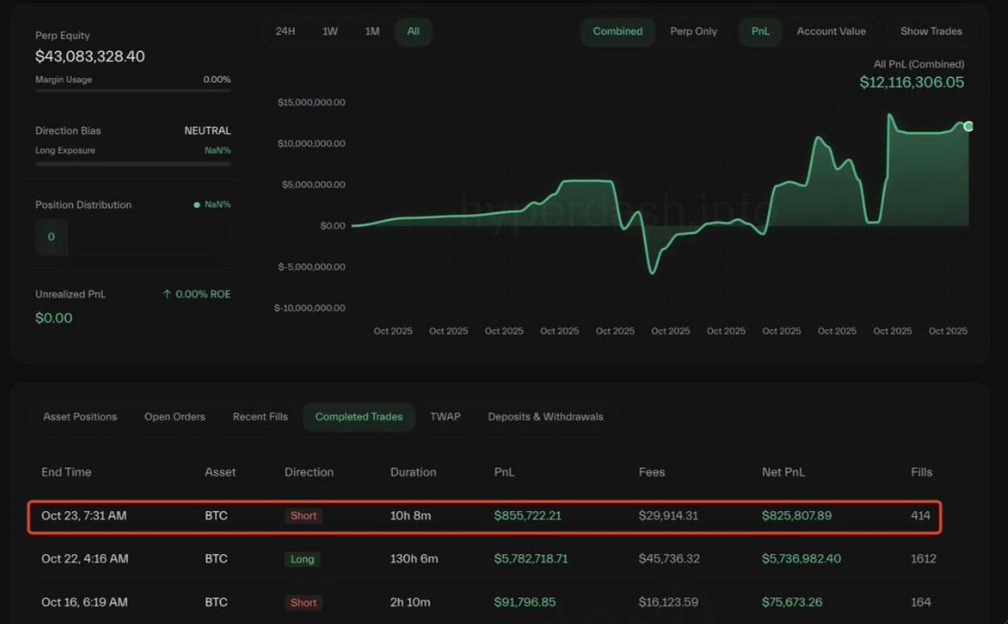

Another high-profile trader, 0xc2a3, closed his short for an $826K profit and opened a $45 million leveraged long position, already showing $50K in unrealised gains.

These strategic reversals suggest large traders are positioning for an upward move, not further downside. Historically, such behaviour often precedes medium-term rallies, as whales absorb liquidity during market uncertainty.

Bitcoin mining profitability: Miners decouple from bitcoin’s price

According to JPMorgan, Bitcoin miners’ market capitalisations have surged since July, even as Bitcoin prices moved sideways.

This decoupling reflects a pivot toward artificial intelligence (AI) infrastructure, which offers steadier cash flows and improved profit margins compared to traditional mining.

The April 2024 halving, which reduced rewards from 6.25 BTC to 3.125 BTC, increased cost pressures. The average cost to mine one Bitcoin is now near $92,000 and projected to reach $180,000 by 2028. Larger miners have adapted by integrating AI server capacity, turning what used to be a cyclical business into a dual-revenue model.

This shift suggests that miner-driven selling pressure may ease, allowing Bitcoin’s price to stabilise even in volatile conditions.

Dolphins keep accumulating: Mid-sized holders signal confidence

Beyond the whales, on-chain data from CryptoQuant shows that “dolphins” - entities holding between 100 and 1,000 BTC - continue to accumulate even after a $19 billion liquidation earlier this month.

Their total annual holdings growth now exceeds 907,000 BTC, maintaining the structural integrity of the bull market. However, short-term data shows their 30-day balance slipping below the moving average, implying temporary caution before renewed accumulation.

This pattern - strong long-term buying with short-term dips - has historically preceded major breakouts, aligning with the broader thesis that Bitcoin’s volatility may be the market’s way of resetting before the next move up.

Macro tailwinds: Rate cuts, inflation, and the safe-haven shift

The September CPI release will be the Fed’s last major data point before its next rate decision. Markets expect a 25-basis-point cut next week, followed by another in December.

Lower interest rates typically weaken the dollar and push liquidity toward risk assets - including crypto. Meanwhile, roughly $7.5 trillion remains parked in U.S. money market funds. As yields decline, some of that capital could migrate toward alternative stores of value like Bitcoin.

This dynamic mirrors gold’s behaviour: when inflation expectations cool and real yields fall, investors rotate toward assets that can retain purchasing power. Bitcoin, often dubbed “digital gold,” stands to benefit from this same macro cycle.

Bitcoin technical insights

Bitcoin continues to trade in a tight range, hovering around $110,300–$110,600, where short-term resistance has capped recent upside attempts. A breakout above $110,600 could attract fresh bullish momentum, opening the way toward $124,000, though some profit-taking may occur along the way.

On the downside, $107,200 remains key support - a break below it could trigger sell-side liquidations and deeper corrections. Meanwhile, the RSI is gradually rising toward the 50 midline, signalling improving momentum but not yet confirming a full bullish reversal. Overall, Bitcoin’s near-term bias is neutral to mildly bullish, with traders watching for confirmation above resistance or breakdowns below support.

Momentum indicators show fading selling pressure and increasing whale accumulation, suggesting buy-side strength is gradually building despite short-term uncertainty.

Bitcoin investment implications

For traders and portfolio managers, Bitcoin’s current structure signals a potential medium-term breakout setup.

- Short-term strategies: Tactical buying near $110K–$111K with stop losses below $105K could capture upside if CPI data confirms a softer inflation print.

- Medium-term positioning: Accumulation remains attractive as smart money flips bullish and macro policy turns supportive.

- Equity exposure: Given their diversified revenue streams, Bitcoin miners transitioning into AI infrastructure could outperform traditional crypto moves.

In sum, Bitcoin’s whipsaw week may be more about preparation than panic - a market-clearing event paving the way for the next directional move. If history and smart money are any guide, the path toward $120K may have just begun.

Bitcoin market scenarios and outlook

If Bitcoin consolidates above $111,000 and macro data confirms easing inflation, a $120,000 retest in November remains plausible. Conversely, any hawkish CPI surprise could trigger another short-term pullback before the broader trend resumes upward.

In both cases, whale accumulation, miner resilience, and macro liquidity support a bullish bias heading into late 2025.

The performance figures quoted are not a guarantee of future performance.