4 طرق لتحسين تداولك بواسطة مؤشرات Synthetic

سواء كنت مبتدئًا في التداول أو متداولًا متمرسًا، فمن المحتمل أنك قد صادفت مصطلح "مؤشرات Synthetic" من قبل. كان لمفهوم مؤشرات Synthetic دورٌ كبير في تحول مجال التداول، حيث يُقدم للمتداولين فرصًا جديدة للاستكشاف وتعطيل الأساليب التقليدية في التداول.

في Deriv، نقدم لك مؤشرات Synthetic ضمن مؤشرات Derived، والتي تسمح لك بتداول الأصول المشتقة من الأسواق المحاكاة على مدار الساعة، طيلة أيام الأسبوع.

ما هي مؤشرات Synthetic؟

تشمل مؤشرات Synthetic مجموعة متنوعة من المؤشرات التي تحاكي بعض الخصائص الواقعية للأسواق التي تم إنشاؤها بواسطة Deriv. مؤشرات Synthetic غير مرتبطة بأي سوق أساسي وبدلاً من ذلك تستند إلى مولد أرقام عشوائية مشفر بشكل آمن.

تقدم Deriv مؤشرات Synthetic التي تحاكي أنماط volatility و crashes و booms والمزيد. تعتمد قيم وتحركات هذه المؤشرات على خوارزميات متقدمة بدلاً من القوى الخارجية.

إحدى أهم ميزات مؤشرات Synthetic الخاصة بـ Deriv هي توافرها للتداول على مدار الساعة طيلة أيام الأسبوع. الآن، لنستكشف كيف يوفر ذلك مزيدًا من المرونة والفرص للمتداولين.

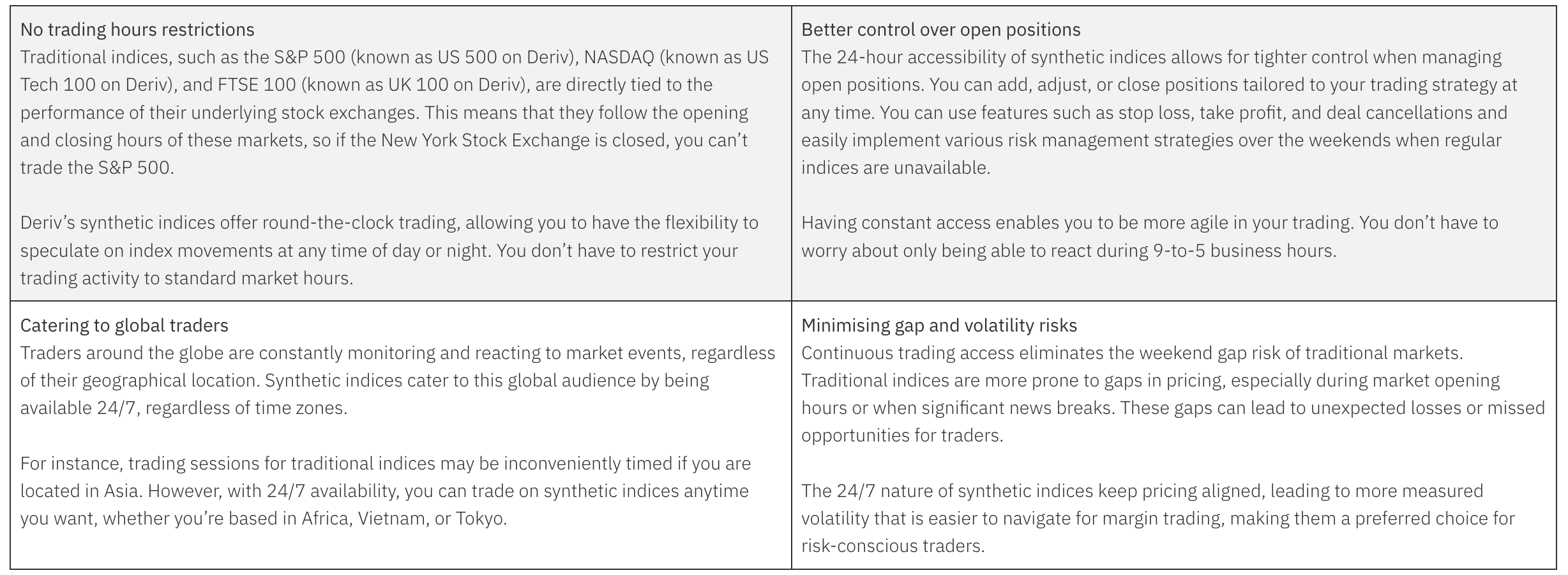

مزايا إمكانية الوصول لمؤشرات Synthetic على مدار الساعة

فيما يلي 4 فوائد رئيسية مرتبطة بإمكانية الوصول إلى مؤشرات Synthetic على مدار الساعة:

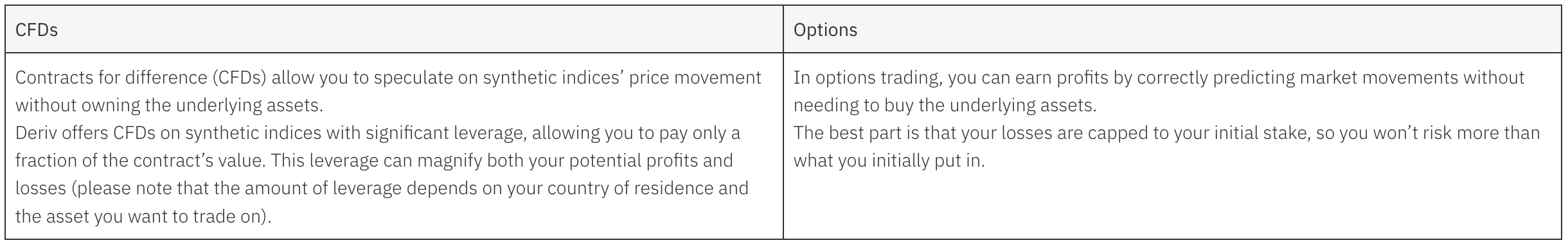

كيفية تداول مؤشرات Synthetic

يمكنك تداول مؤشرات Synthetic على Deriv باستخدام الخيارات (Options) وعقود الفروقات (CFDs).

يمكنك تداول مؤشرات Synthetic على Deriv في Deriv Trader، Deriv MT5، Deriv X، وDeriv Bot.

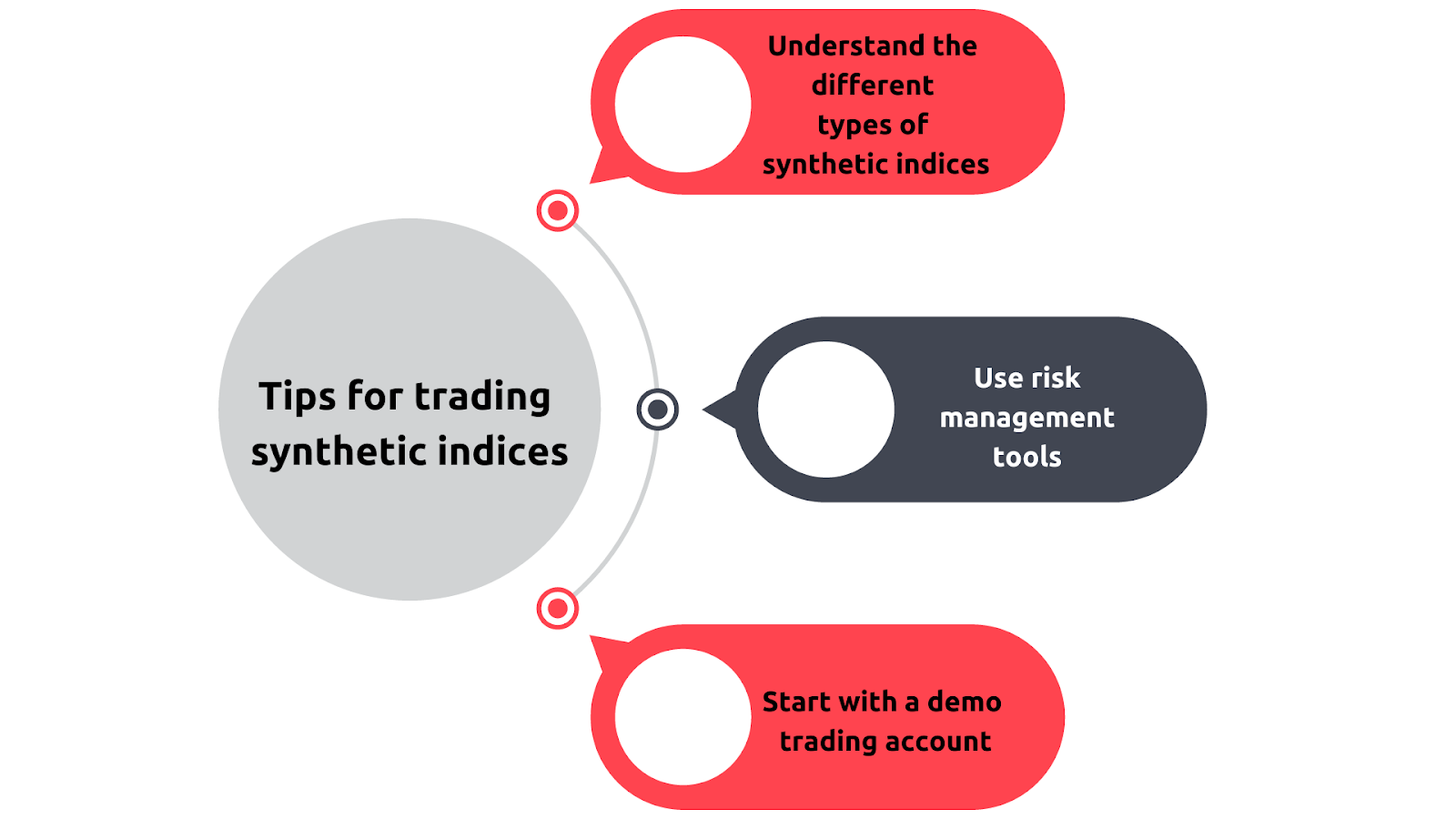

نصائح لتداول مؤشرات Synthetic

من المهم وضع بعض النصائح المفيدة في الاعتبار قبل تداول مؤشرات Synthetic.

- فهم الأنواع المختلفة لمؤشرات Synthetic

هناك العديد من مؤشرات Synthetic، ولكل منها ميزات وخصائص فريدة. يعد فهم الأنواع المختلفة من مؤشرات Synthetic أمرًا ضروريًا قبل بدء تداولها. تشمل بعض المؤشرات التي يمكنك تداولها على Deriv ما يلي: Drift switch، Range break، Crash/boom و Volatility.

- قم باستخدام أدوات إدارة المخاطر

يمكن أن تكون مؤشرات Synthetic متقلبة، لذا فإنه من الضروري استخدام أدوات إدارة المخاطر مثل الحد من الخسارة وجني الأرباح وإلغاء الصفقة لحماية رأس المال الخاص بك. يرجى ملاحظة أن خاصية إلغاء الصفقة تنطبق فقط عندما تكون خاصية الحد من الخسارة وجني الربح غير فعالة.

- ابدأ بحساب تداول تجريبي

إذا كنت جديدًا في تداول مؤشرات Synthetic، فمن الأفضل أن تبدأ بحساب تجريبي. سيساعدك ذلك على تقليل المخاطر أثناء تعلم كيفية تداول مؤشرات Synthetic. جرب التداول بدون مخاطر باستخدام الحساب التجريبي المجاني على منصة Deriv. ، الذي يأتي مزودًا بـ 10,000 دولار من الأموال الافتراضية.

تعد مؤشرات Synthetic أداة تداول مرنة ومتعددة الاستخدامات يمكن لجميع المتداولين استخدامها بغض النظر عن مستوى خبرتهم. إن توفر تداول مؤشرات Synthetic على مدار 24 ساعة يميزها عن المؤشرات التقليدية ويوفر مزايا كبيرة للمتداولين. بالتخلص من قيود ساعات التداول، تمكّنت مؤشرات Synthetic من إعطاء الحرية للمتداولين.

إذا كنت تبحث عن طريقة للتداول في الأسواق على مدار الساعة، مع مزيد من المرونة والتحكم، فقد تكون مؤشرات Synthetic هي الخيار المناسب لك.

تنويه:

المعلومات الواردة في هذه المدونة هي للأغراض التعليمية فقط وليس المقصود منها تقديم المشورة المالية أو الاستثمارية.

لا تتوفر منصة Deriv X و Deriv Bot وتداول الخيارات (CFDs) للعملاء المقيمين داخل الاتحاد الأوروبي.

قد يعتمد توفر Deriv MT5 وبعض مؤشرات Synthetic على بلد إقامتك.

نحن هنا لمساعدتك! إذا كان لديك أي سؤال، لا تتردد في التواصل معنا. يعود الأمر إليك!