Precious metals pull back: Is this a pause or a peak for Gold and Silver prices?

After an explosive January rally that pushed gold close to $5,600 per ounce and sent silver more than 60% higher on the month, both metals have turned sharply lower. Gold slid nearly 4% in Asian trade, while silver retreated even more aggressively from record highs, raising doubts over whether the rally has simply overheated.

So far, the evidence points more towards a pause than a peak. The sell-off has been driven by profit-taking and renewed uncertainty over US monetary policy, rather than a collapse in the forces that powered the rally. With markets focused on President Donald Trump’s imminent pick for the next Federal Reserve chair, precious metals are recalibrating to expectations — not abandoning their longer-term narrative.

What’s driving the pullback in precious metals?

The immediate trigger for the decline has been political rather than economic. President Trump is expected to announce his nominee to replace Federal Reserve Chair Jerome Powell, with former Fed governor Kevin Warsh widely seen as the frontrunner. Warsh has previously supported sharper rate cuts and criticised the Fed’s policy stance, fuelling uncertainty around the future direction of US monetary policy.

That uncertainty initially supported gold’s safe-haven appeal, pushing prices to record highs. However, once positioning became crowded, the same uncertainty began to work in the opposite direction. Traders moved to lock in profits as clarity approached, particularly after the US dollar rebounded from recent lows. When gold rises nearly 25% in a single month, it takes very little to trigger a correction.

Why it matters for gold and silver investors

The scale of the pullback matters because it reveals how much of the rally was driven by flows rather than fundamentals. Gold and silver were not only hedges against geopolitical risk, but also expressions of declining confidence in US assets, amid fiscal concerns, tariff threats, and public criticism of the Federal Reserve.

As Julius Baer strategist Carsten Menke warned, markets dominated by momentum do not require a major shock to reverse. “It does not need much for a correction,” he said, highlighting how fragile sentiment can become once enthusiasm peaks. For investors, this shift raises a critical question: whether the correction is clearing excess optimism, or exposing a deeper vulnerability in the metals trade.

How silver’s volatility is shaping the broader metals market

Silver has led both the rally and the retreat. Prices pulled back towards $113 after hitting a record high near $121.66, ending a seven-day winning streak. Despite the correction, silver remains on track for gains of over 60% this month, underscoring just how extreme recent price action has been.

Silver’s dual role amplifies its swings. Alongside safe-haven demand, it is heavily exposed to industrial growth expectations, making it more sensitive to shifts in risk sentiment. As US equity markets slid and investors reduced exposure across asset classes, silver bore the brunt of the liquidation, dragging broader precious metals sentiment with it.

Is this a pause or a peak?

Despite the sharp pullback, the longer-term case for gold remains intact. Futures markets show smaller losses than spot prices, suggesting investors are not abandoning positions but trimming exposure. With inflation still elevated and markets pricing in the Fed’s next rate cut as early as June, lower real yields could continue to support gold over time.

The key risk is timing. If the dollar continues to strengthen and political pressure on the Fed eases, gold and silver may struggle to regain momentum immediately. However, renewed equity market stress or an escalation in geopolitical tensions would quickly revive safe-haven demand. In that sense, the recent decline looks more like a pause driven by positioning, rather than a definitive peak in the precious metals cycle.

Key takeaways

The recent pullback in gold and silver reflects a market that surged ahead of clarity, not one that has lost its foundation. Political uncertainty around the Federal Reserve and a stronger dollar have prompted profit-taking after an exceptional rally. Whether this proves to be a pause or a peak will depend on interest rates, the dollar, and global risk sentiment in the weeks ahead.

Gold technical outlook

Gold has pulled back from recent highs after a sharp acceleration, with price retreating from the upper Bollinger Band while volatility remains elevated. The Bollinger Bands are still widely expanded, indicating that the market remains in a high-volatility regime despite the recent pause.

Momentum indicators remain stretched: the RSI is holding just above 70, suggesting that overbought conditions persist even as upward momentum has flattened. Trend strength remains exceptionally strong, with ADX readings elevated, indicating a mature, well-established trend phase. Structurally, price remains well above earlier consolidation zones around $4,035 and $3,935, underscoring the scale of the preceding advance.

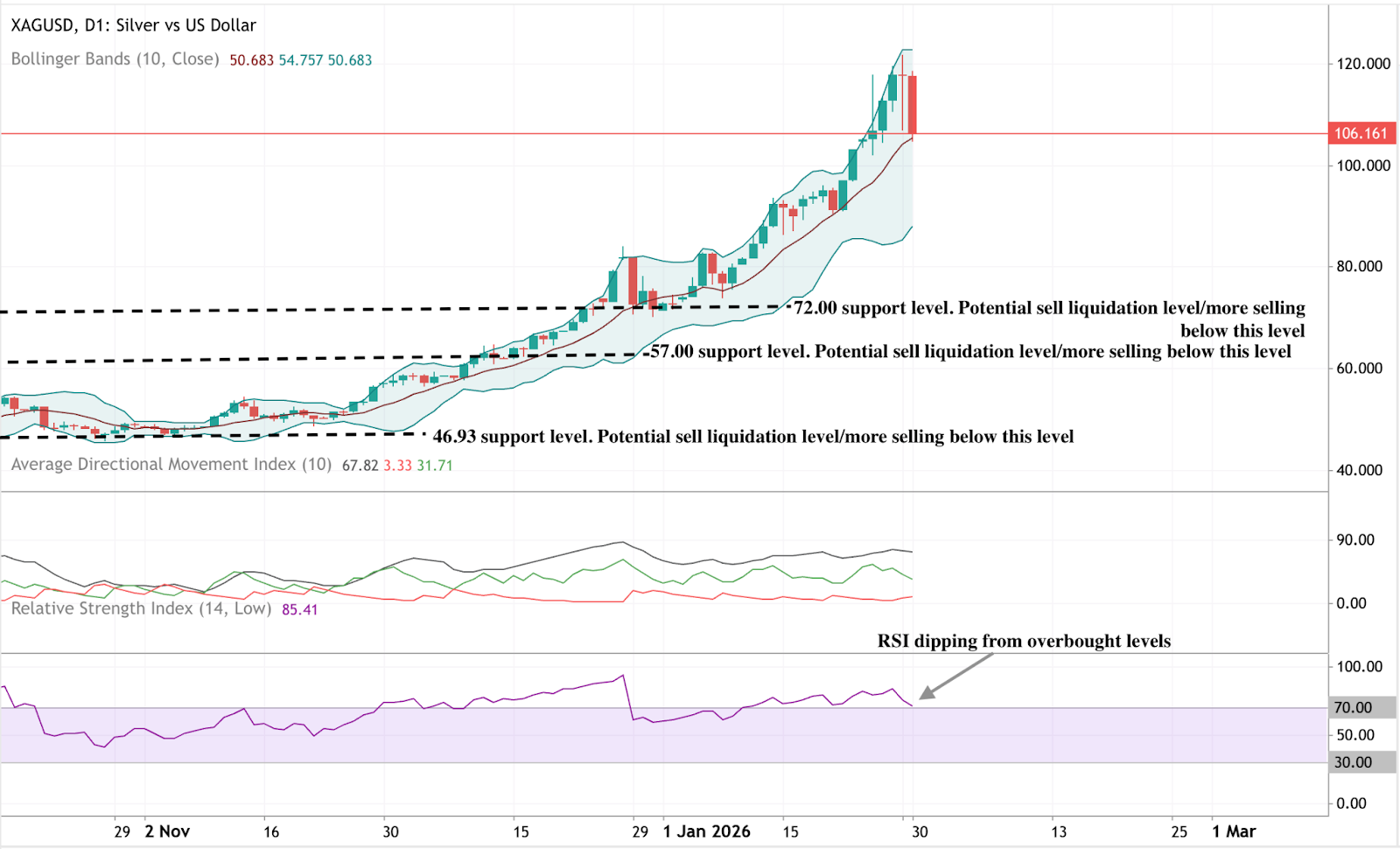

Silver technical outlook

Silver has retreated from recent highs following a sharp upside extension, with price pulling back from the upper Bollinger Band while remaining within a broadly elevated range. Despite the pullback, the Bollinger Bands remain widely expanded, indicating that volatility is still elevated relative to earlier periods.

Momentum indicators show easing conditions: the RSI has dipped from overbought territory, signalling a moderation in upside momentum rather than a full reversal. Trend strength remains pronounced, with ADX readings still elevated, indicating a strong, mature trend environment. Structurally, price remains well above earlier consolidation zones around $72, $57, and $46.93, underscoring the scale of the prior advance.

The information contained on the Deriv Blog is for educational purposes only and is not intended as financial or investment advice. The information may become outdated, and some products or platforms mentioned may no longer be offered. We recommend you do your own research before making any trading decisions. The performance figures quoted are not a guarantee of future performance.