Gold surges as Fed cuts trigger a new wave of momentum

Gold’s latest rally captures the market’s growing conviction that the Federal Reserve’s rate-cut cycle is no longer a one-off adjustment but a structural shift. Based on data, spot prices climbed toward $4,275 in early Asian trading, extending a run that began as soon as the Fed delivered its 25-basis-point cut—the third reduction of the year. Silver moved in tandem, briefly touching a record $62.37 as investors rotated into assets that thrive when real yields sink.

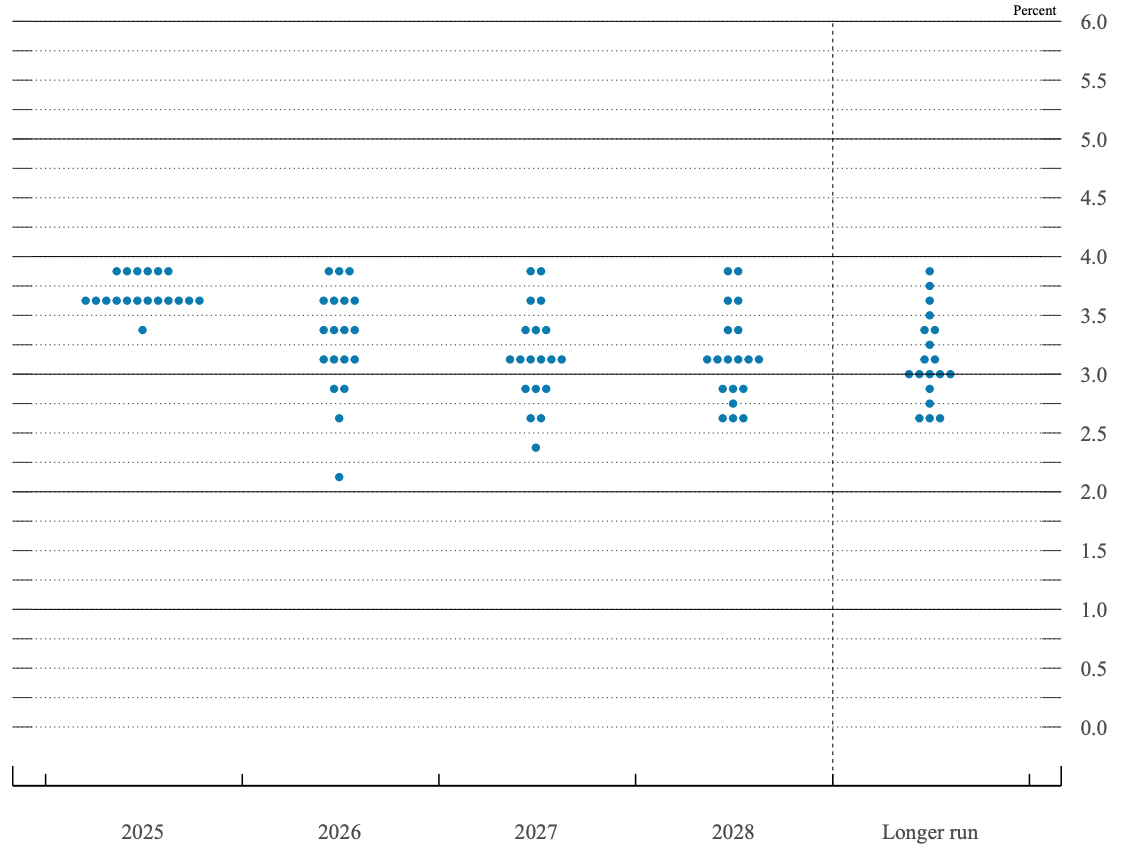

Market watchers noted this story matters because the policy environment shaping global capital flows has turned decisively. Markets are now pricing in an additional 75 basis points of cuts in 2025, a revision that has recalibrated expectations for growth, inflation, and risk appetite. The coming months will show whether the macro data justifies this easing bias or challenges it.

What’s driving gold higher?

According to reports, much of gold’s strength stems from a sharp repricing of the Fed’s policy path. The central bank’s latest 25-basis-point cut pushed the funds rate to its lowest level in three years, triggering an immediate drop in the US Dollar and reinforcing the downward trend in real yields.

When the cost of holding yield-bearing assets falls, gold’s lack of a coupon becomes less of a penalty. Investors treat this environment as a green light to accumulate positions that protect purchasing power, especially when policy easing appears set to continue. Analysts at CBA argue that the Fed’s actions have created a “powerful cyclical tailwind” that could last well into next year.

Silver’s surge reveals the more speculative side of this trade. It tends to amplify turning points in monetary cycles, and traders have seized the combination of momentum and macro support. Silver’s push above $62 reflects a belief that industrial demand will hold even as borrowing costs fall. The metal is behaving as both a hedge and a high-beta trade, capturing safe-haven flows alongside speculative interest from trend-followers.

Why it matters

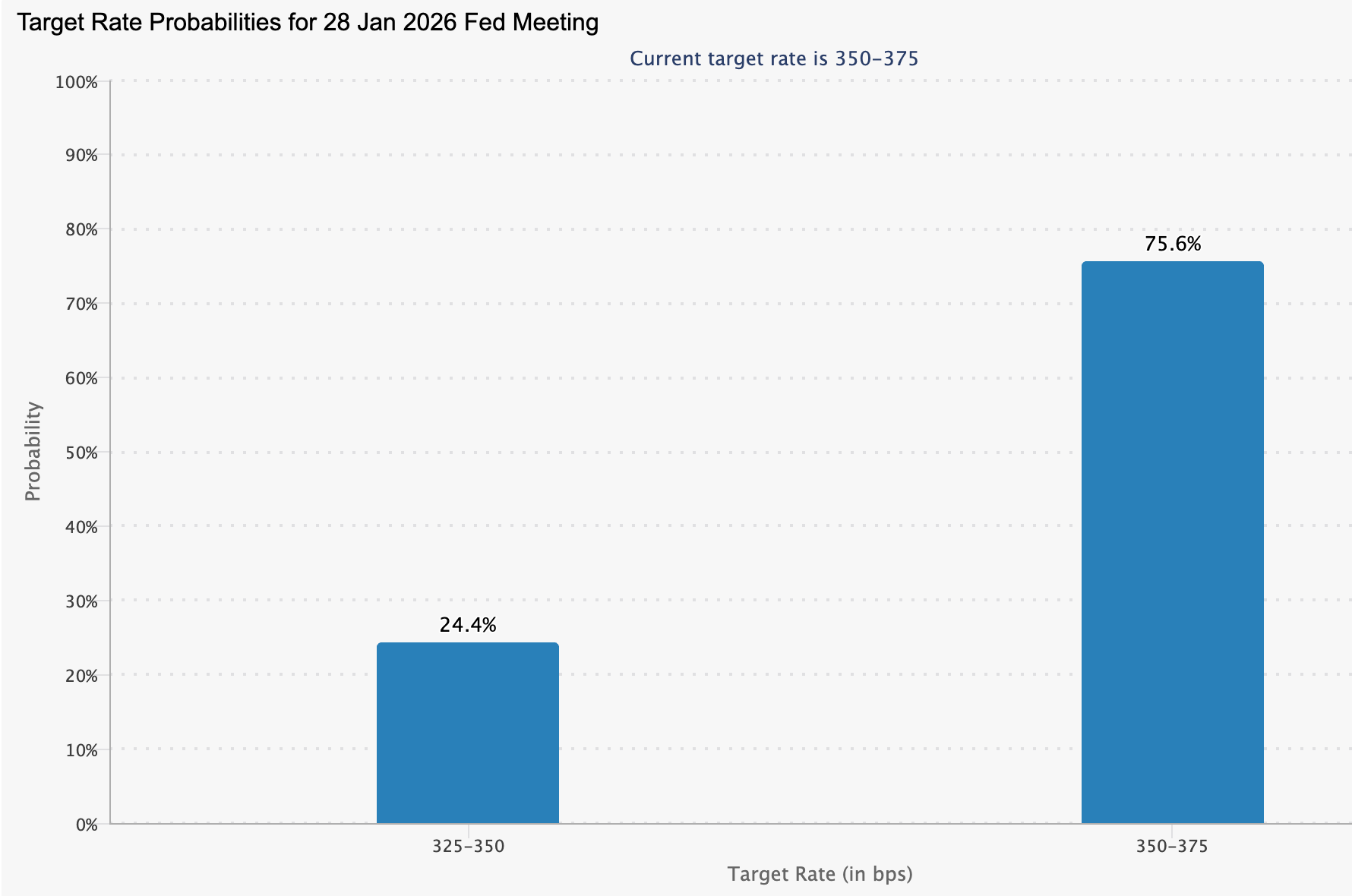

Analysts noted that gold is increasingly serving as a barometer of confidence in the Fed’s ability to manage inflation while supporting economic growth. Markets reacted strongly to the rise in US jobless claims - the largest increase in nearly four and a half years - which reinforced expectations that monetary easing will continue. With the odds of a January pause rising to 75.6%, traders see a narrow path forward: lower rates, weaker yields and sustained demand for defensive assets.

Strategists warn that this shift is not just mechanical. One London-based metals analyst noted that “gold is now pricing the direction of policy rather than the pace,” signalling a market that believes the Fed is preparing to cushion a softening labour market. Such sentiment increases the likelihood that gold remains supported even if nominal rates stabilise, since real yields are doing the heavy lifting.

Impact on markets and investors

Experts expressed that the immediate impact is concentrated in the metals complex rather than across broader risk assets. Gold is receiving steady inflows from investors who view it as the purest representation of declining real yields. Funds with mandates to hedge against policy uncertainty have increased their allocations, while discretionary traders are using the breakout above $4,250 to justify new upside calls. The result is a market with momentum and fundamental support aligned in a rare way.

Silver is attracting a different breed of participant. Its breakout to record territory encourages short-term systems and CTA strategies to extend long exposure. This dynamic tightens liquidity around key levels and can amplify moves when positioning becomes one-sided. Industrial users, meanwhile, are closely monitoring volatility as higher prices influence their purchasing strategies for 2025.

Retail traders face a more nuanced landscape. Gold’s high price level may reduce accessibility, but the directional clarity of trade policy easing, which favours stronger metals, keeps interest intact. The key is whether inflation stabilises or rebounds into the Fed’s radar, reshaping the path of rate cuts.

Expert outlook

According to analysts, forecasts hinge on the incoming US data. If inflation softens further and labour-market fragility persists, markets are likely to reinforce expectations for 75 basis points of easing next year. That backdrop would enable gold to maintain its position above $4,250 and could sustain silver near record highs. The structural bid from reserve managers and institutional allocators seeking diversification will also matter, especially as geopolitical risks persist in the background.

The alternative scenario is a sudden rise in wage growth or a surprise rebound in inflation. Either development would compel the Fed to slow or even halt its easing path, lifting real yields and tempering gold’s ascent. The move would not undermine the long-term case for precious metals, but it could inject volatility and reset expectations for the pace of gains. Traders are watching labour data, core inflation trends and Fed communications as the next major catalysts.

Key takeaway

Gold’s advance above $4,250 is more than a reaction to a single policy move; it reflects a broader shift in how markets value defensive assets in an easing cycle. Real yields are falling, jobless claims are rising, and traders are aligning with expectations of deeper cuts next year. Silver’s breakout underscores the power of momentum when macro signals and positioning reinforce each other. The next phase depends on US inflation and wage data, which will determine whether the Fed can continue easing without reigniting price pressures.

Gold technical insights

Gold has extended its rebound, breaking cleanly above the US$4,240 zone and pushing towards the US$4,365 resistance level, where profit-taking typically emerges. The move is supported by the expansion of Bollinger Bands, signalling rising volatility and strengthening bullish momentum. The RSI is also drifting toward overbought territory, suggesting that the price may be entering a stretched phase, even as buyers remain firmly in control. Immediate support now sits at US$4,035; holding above it maintains the bullish structure, while a break below would expose the deeper US$3,935 liquidation zone.

The performance figures quoted are not a guarantee of future performance.