How the Fed rate cut affects gold’s outlook heading into December

Gold is holding steady near the $4,000 mark after the U.S. Federal Reserve cut interest rates by 25 basis points to the 3.75%–4% range - a widely expected move that revealed deep divisions within the central bank.

While lower rates typically support gold by reducing the appeal of yield-bearing assets, Chair Jerome Powell’s cautious tone and the split vote have complicated the picture.

With Powell warning that another rate cut in December is “not a foregone conclusion,” traders are now caught between two outcomes: a break above $4,100 if economic data softens, or a correction toward $3,900 if the Fed turns hawkish in December.

Key takeaways

- The Fed cut rates by 25 bps to a 3.75%–4% target range - its second cut of 2025, but not unanimously.

- Stephen Miran voted for a 50 bps cut, while Jeffrey Schmid preferred no change, underscoring internal division.

- The statement described moderate growth, slower job gains, and inflation still “somewhat elevated.”

- The Fed will end balance sheet reduction on 1 December, signalling a quiet pivot toward neutral liquidity policy.

- Gold trades between $3,990–$4,010, as Powell’s comments temper expectations for further easing.

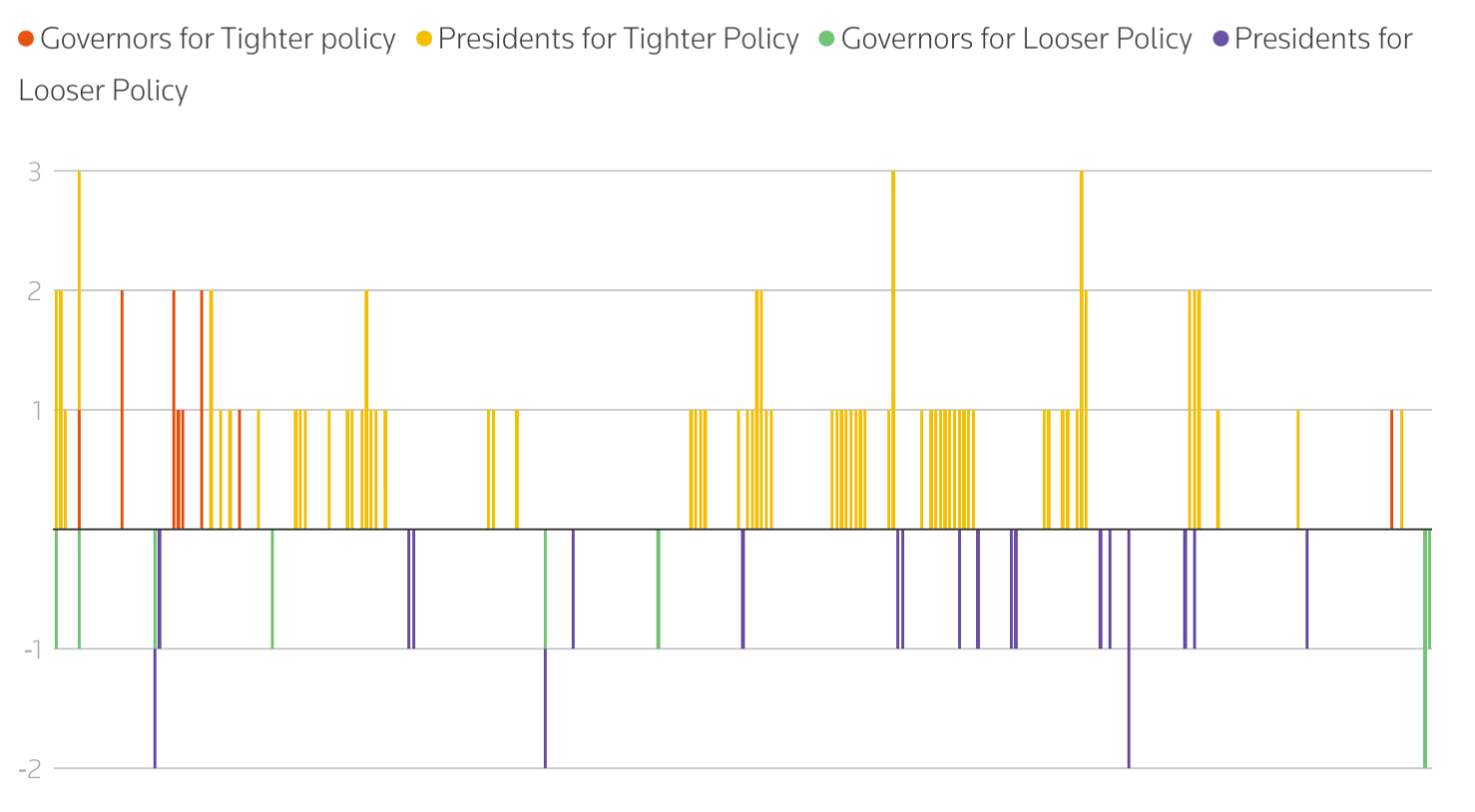

The Federal Reserve interest rate divided decision

The latest policy meeting ended with a split 10-2 vote, reflecting an increasingly fractured Federal Open Market Committee (FOMC). Most members supported a 25 bps reduction to cushion a cooling labour market, but dissent came from both directions.

- Governor Stephen Miran argued for a 50 bps cut, warning that slower job growth warranted stronger action.

- Kansas City Fed President Jeffrey Schmid, however, voted to hold rates steady, citing inflation that “remains somewhat elevated.”

The official statement struck a cautious tone, noting that “economic activity has been expanding at a moderate pace” while acknowledging “job gains have slowed this year and the unemployment rate has edged up but remained low.” Inflation, the Fed said, “has moved up since earlier in the year and remains somewhat elevated.”

This rare two-way dissent marks only the third time since 1990 that Fed policymakers disagreed in opposite directions - a sign of deep uncertainty about the economic outlook.

Powell’s message: a cut, not a pivot

At the press conference, Jerome Powell stressed that this was a “solid” move to support a gradually cooling economy - not the start of an aggressive easing cycle. He cautioned that “a further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

Powell also pointed to the ongoing government shutdown, which has disrupted official data collection, making it harder for policymakers to gauge economic momentum.

“When you’re driving in the fog, you slow down,” he said - a metaphor for the Fed’s new watch-and-wait posture.

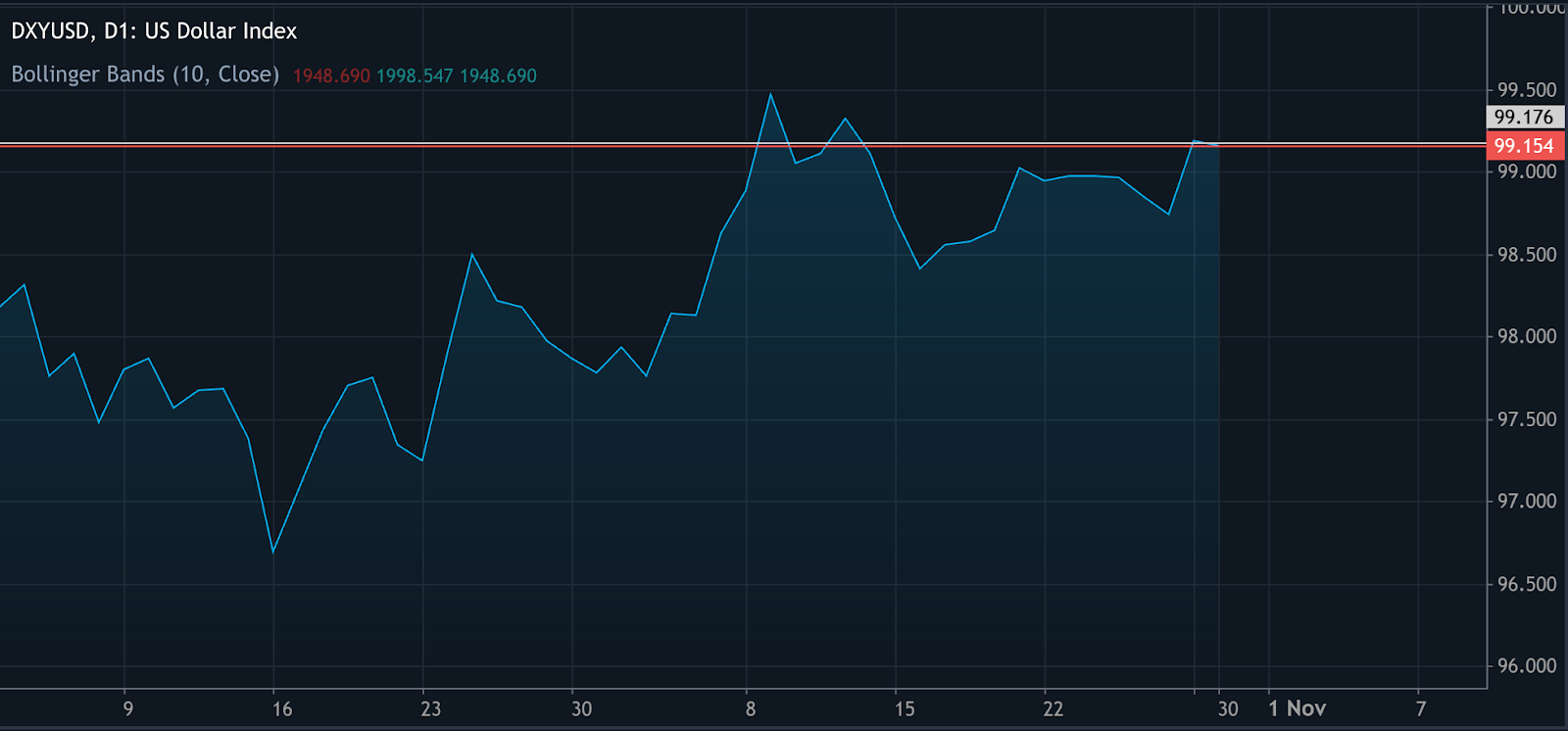

Markets, which had priced in another cut for December, were quick to adjust. Fed funds futures trimmed expectations for additional easing, gold pared gains, slipping back from intraday highs near $4,010 and the U.S. dollar index (DXY) rebounded.

The message was clear: policy is not on a preset course. This “pause disguised as a cut” has left gold traders uncertain whether to expect another round of support or a longer holding phase.

The quiet pivot: ending balance sheet reduction

Beyond the rate cut, one key line in the Fed statement went largely unnoticed: the Committee decided to conclude the reduction of its aggregate securities holdings on 1 December. This effectively ends the Fed’s multi-year quantitative tightening (QT) campaign - a significant shift in liquidity management.

The move suggests the central bank aims to stabilise money markets after signs of funding stress and preserve flexibility ahead of a potentially volatile election year.

In practice, ending QT means the Fed will reinvest maturing securities rather than shrinking its balance sheet, keeping liquidity conditions loose. For gold, that’s typically supportive: more liquidity tends to weaken real yields and boost demand for non-yielding assets like bullion. However, because Powell’s tone was measured and cautious, traders see this more as risk management than an outright pivot to stimulus.

Market reaction: volatility replaces certainty

Gold’s intraday performance captured the market’s confusion. The metal briefly rallied after the announcement, but quickly pulled back once Powell began speaking. As of late Wednesday, XAU/USD fluctuated between $3,990 and $4,010, holding steady but showing no conviction.

Meanwhile, the U.S. dollar strengthened as traders trimmed rate-cut bets, while Treasuries extended gains, signalling expectations of slower growth rather than renewed inflation.

Equity markets initially rose, then fell back as investors realised Powell had effectively walked back expectations for a December cut.

“Gold had a logical reaction to Powell trying to walk back expectations for a December cut. That’s dollar positive and gold negative,” said Peter Grant, senior strategist at Zaner Metals.

The muted price response shows that gold is now trading less on rate outcomes and more on policy credibility - how much conviction the Fed can maintain in its cautious easing stance.

Gold price forecast: The road to December

Heading into the final meeting of 2025, the key question is whether the Fed’s caution was justified - or premature.

- If inflation eases and job data soften, the Fed may be able to justify another 25 bps cut, potentially propelling gold above $4,100.

- If growth holds steady and inflation proves sticky, the Fed may pause, sending gold back toward $3,900 as the dollar extends gains.

Powell also noted that internal Fed views are diverging sharply - some members see the current stance as still “modestly restrictive,” while others believe rates are now “near neutral.” This widening policy gap makes December’s meeting potentially decisive for both gold direction and market confidence.

Gold technical insights

Gold prices are currently consolidating near the $3,958 support level, with price action showing fatigue after the recent rally. The Bollinger Bands have started to narrow, signalling that volatility is easing. The price is hovering around the middle band, suggesting indecision among traders - neither a clear bullish continuation nor a confirmed bearish reversal has yet formed.

The RSI, has now flattened near the midline (50). This flattening pattern reflects a balance between buying and selling pressure, implying that momentum is neutral and traders are waiting for a decisive move below or above key levels.

On the downside, a break below the $3,958 support could trigger sell liquidations, with the next potential target around $3,630. Conversely, if bulls regain control and push the price higher, resistance is seen near $4,365 - a zone where profit-taking and renewed selling could emerge.

Traders analysing these levels can use Deriv MT5 for advanced charting tools, technical indicators, and live gold market data. Traders on Deriv platforms can also use multipliers to optimise their exposure to gold’s short-term volatility while managing risk, allowing them to benefit from smaller price movements without committing large capital upfront.

Gold investment implications

For traders, this Fed meeting marks the start of a data-driven phase in gold pricing rather than a one-way rally.

- Short-term outlook: Expect sideways trading between $3,950–$4,100, with spikes driven by employment and inflation reports.

- Medium-term bias: Modestly bullish if liquidity remains abundant after QT ends.

- Long-term view: Gold’s structural support remains intact as global central banks pivot toward looser liquidity management.

Ultimately, Powell’s pause, not the cut itself, defines this moment. The Fed has slowed the pace of easing, but by quietly ending its balance sheet runoff, it has also laid the groundwork for long-term gold resilience - even if short-term rallies face resistance.

Before entering new positions, traders can use Deriv’s trading calculator to estimate margin requirements, contract sizes, and potential profit or loss - a practical tool for planning gold trades around volatile macro events.

The performance figures quoted are not a guarantee of future performance.