外匯交易:此流動性最強的市場如何運作

外匯交易在 2023 年每日平均交易超過 6 兆 USD,是全球最大的市場。 其以流動性聞名,可實現每天 24 小時、每週 5 天隨選即用交易。

外匯中的流動性是什麼?

從基本開始,外匯流動性是指貨幣對可以購買或出售的容易。 在流動性強的市場中,交易者不必擔心缺乏交易對手,因為市場中總是有足夠的買家和賣家。

如何辨識外匯貨幣對的流動性?

交易者衡量外匯市場流動性的一種方法是透過分析 bid-ask spread。 這是指在特定外匯對中,買方願意支付的最高價格 (bid) 與賣方願意接受的最低價格 (ask) 之間的差額。 較小的 spread 通常表示有足夠的買家和賣家願意以這些價格交易。 值得注意的是,由於定價模式和加成的差異,經紀商之間的 spreads 會有所不同。

在下面的 Deriv MT5 平台範例中,可以看到,由於流動性高,EUR/USD 等主要貨幣對的 spreads 較小 (0.00005),而 CAD/JPY 等次要貨幣對的 spreads 略大 (0.019),因為流動性較低。 請記住,外匯 spreads 通常比其他資產類別更小、更穩定。

辨識外匯流動性的另一種方法是查看交易量。 當交易量較高時,通常表示市場上的買家和賣家數量較多,導致流動性增加。 一天 24 小時內,交易量往往在東京交易時段開始增加,在倫敦交易時段持續上升,然後在紐約交易時段達到高峰。

交易量可以在 Deriv MT5 圖表的插入> 指標> 交易量> 交易量下看到,如下所示。

分析外匯市場

對外匯有興趣的交易者應該關注經濟資料和地緣政治事件。

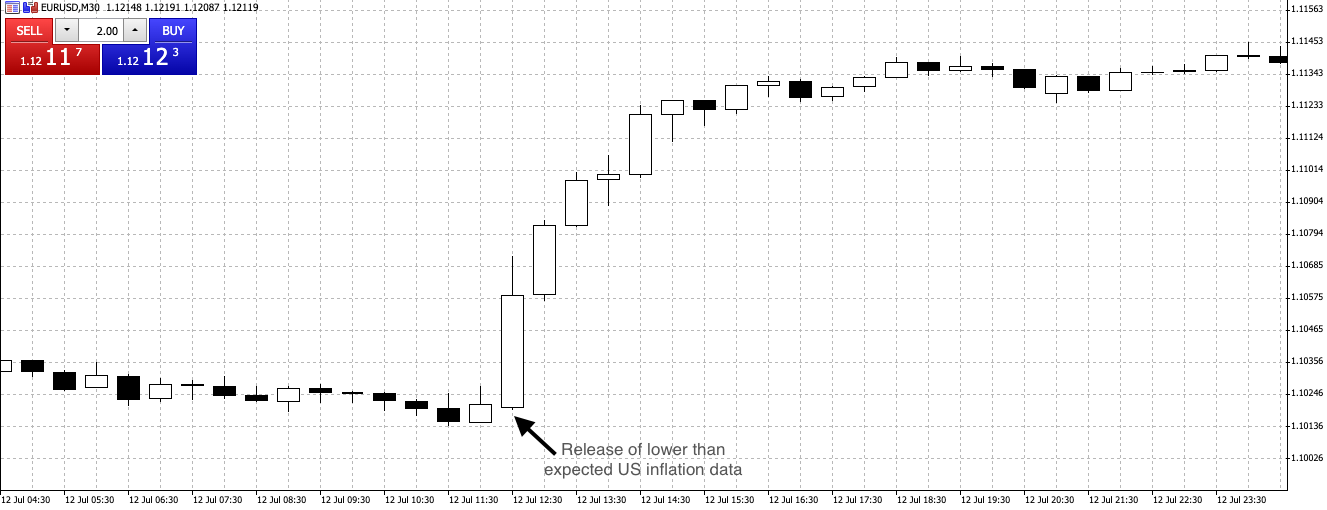

值得注意的是,一個國家的通膨資料的發佈備受期待。 高於預期的通膨資料可能導致央行提高利率,吸引尋求更高利息收入的交易者,從而增加貨幣的需求和價值。 相反,在下面的 Deriv MT5 平台範例中,可以看到低於預期的美國通膨資料對市場暗示利率將會下降,使得 USD 對投資者的吸引力減弱。

地緣政治事件也會影響外匯市場的價格波動。 國家之間的政治衝突和貿易爭端可能引發外匯市場的風險規避情緒,導致投資者將資金轉移到更安全的資產。 選舉也可能導致市場波動,影響貨幣價值。

適合您的外匯交易

隨著世界經濟走向全球化,事件的連結變得更加緊密。 透過密切監控這些因素並將其與其他交易技巧結合,交易者可能會增加更成功交易的機會。

使用預先備有虛擬資金的免費示範帳戶以了解這個流動性極強的市場如何運作。

免責聲明:

本部落格所包含的資訊僅供教育用途,不可視為金融或投資建議。

Deriv MT5 的可用性可能取決於居住國家/地區。

這是一段段落文字。