Why XRP is slipping even as institutional money flows in

XRP’s price action is telling a familiar crypto story: analysts say institutions are still buying while retail traders are quietly stepping away. Spot ETF inflows into XRP surged to almost $8 million in a single session, extending a four-day streak of institutional demand. Yet price momentum continues to weaken, weighed down by falling futures activity and shrinking liquidity.

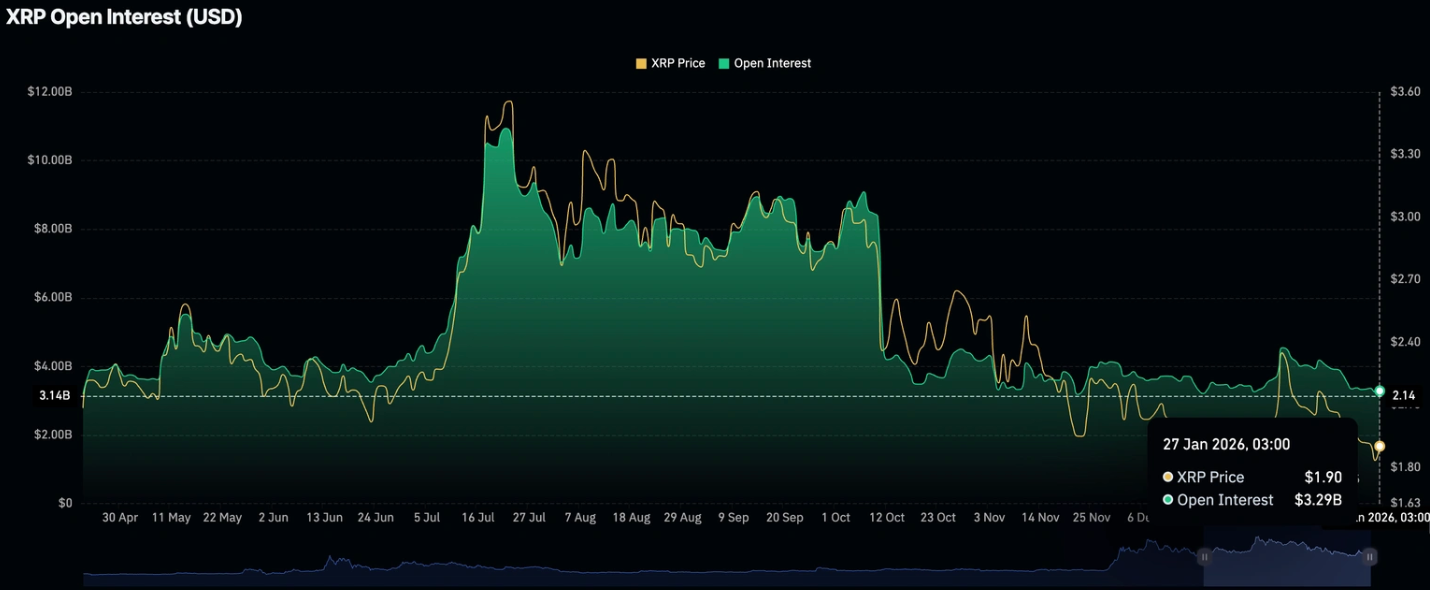

At the same time, XRP futures open interest has slipped close to yearly lows around $3.29 billion, signalling fading conviction among leveraged traders.

This growing imbalance between institutional flows and retail participation is shaping XRP’s near-term outlook and raising questions about whether ETF demand alone can stabilise prices.

What’s driving XRP’s slippage?

The most immediate drag on XRP is coming from the derivatives market. Futures open interest, which reflects the total value of outstanding leveraged positions, is hovering just above its year-low. When open interest declines, it usually means traders are closing positions rather than opening new ones, reducing speculative momentum and weakening price support.

This trend is not isolated to XRP. Across the crypto market, futures activity has contracted sharply. Total crypto open interest has fallen to $128 billion, the weakest level since early January, according to CoinGlass. As liquidity dries up, altcoins tend to suffer first, particularly those like XRP that rely heavily on speculative participation to drive short-term price moves.

Why it matters

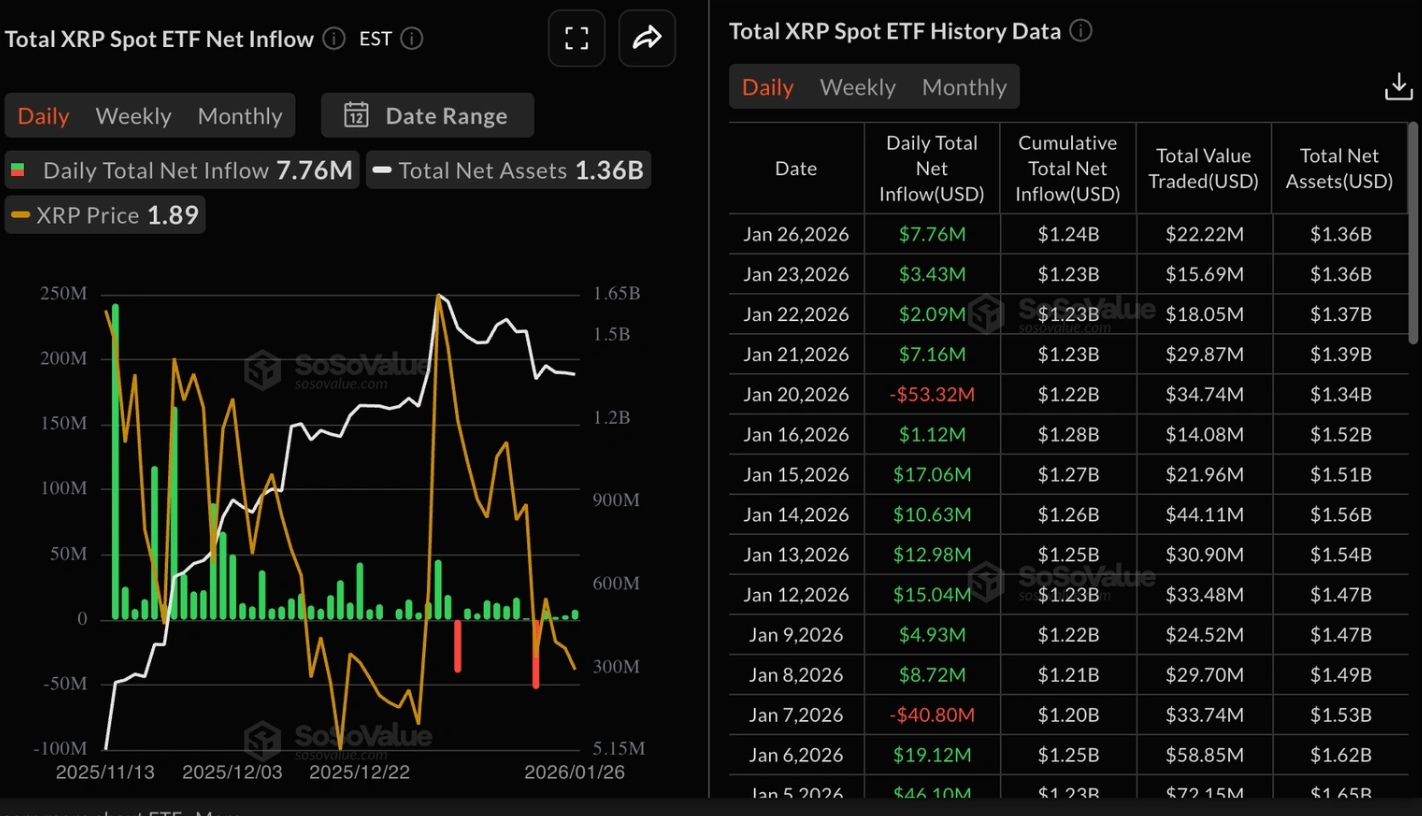

Despite the weak derivatives backdrop, institutional interest in XRP has remained intact. Data from SoSoValue shows that XRP spot ETFs attracted nearly $8 million in inflows on Monday, more than double Friday’s total. Cumulative inflows now stand at $1.24 billion, with net assets reaching $1.36 billion, signalling sustained demand from longer-term investors.

However, this institutional support has limits. As Samer Hasn, Senior Market Analyst at XS.com, explains, “liquidity is shrinking across channels,” noting that recent ETF inflows came after $1.3 billion of outflows last week. Without retail traders adding volume and leverage, ETF buying may slow price declines, but struggle to ignite a meaningful recovery.

Impact on the crypto market

XRP’s weakness reflects a broader shift in market behaviour. As macro uncertainty persists, capital has rotated away from speculative assets and into safer havens. Within crypto, this has favoured Bitcoin over altcoins, leaving tokens like XRP exposed when liquidity conditions tighten.

The effect is already visible in price action. XRP recently recorded seven consecutive down sessions, extending a longer-term pattern in which it has declined in 13 of the past 14 trading days. In low-liquidity environments, even modest selling pressure can push prices lower, reinforcing bearish sentiment and discouraging fresh participation.

Expert outlook

Analysts remain cautious on XRP’s near-term prospects. While ETF inflows provide a structural bid, they are not enough to offset declining derivatives participation. A sustained recovery would likely require a rebound in futures open interest alongside improving trading volumes and broader risk appetite.

For now, XRP appears vulnerable to further downside if liquidity conditions do not improve. Traders will be watching closely for signs of renewed speculative interest, particularly any stabilisation in open interest or a shift in broader crypto sentiment. Until then, institutional inflows may act as a buffer rather than a catalyst.

Key takeaway

XRP’s decline highlights a widening gap between institutional interest and retail participation. While ETF inflows continue to provide support, fading derivatives activity and shrinking liquidity are weighing on prices. Until speculative demand returns, XRP may remain under pressure. The next key signal to watch is whether futures open interest begins to recover.

XRP technical outlook

XRP is stabilising after a sharp advance and subsequent pullback, with price now consolidating near the mid-range of its recent structure. Bollinger Bands have narrowed following a prior expansion, indicating a contraction in volatility as directional momentum has eased.

Momentum indicators reflect this moderation: the RSI is rising gradually toward the midline, suggesting improving momentum from previously weaker levels without a return to overbought conditions. Trend strength remains present but less pronounced, with ADX readings indicating a slowdown in directional intensity compared with earlier phases.

Structurally, price remains bounded between the upper zones near $2.40–2.60 and the lower region around $1.80, reflecting a market environment characterised by consolidation rather than active price discovery.

The performance figures quoted are not a guarantee of future performance.